In this post, we’ll explain what Google Pay is, how you set it up, what you can use it for, and which devices you can run it on – basically, everything you need know!

First and Foremost: What is Google Pay?

You have a debit card, right? You use that card to make payments when you’re out and about shopping. You can also use that card to make payments online. This saves you having to carry cash. And it also means you can make online purchases without using things like PayPal.

For at least a decade and a half, debit cards and credit cards have been the default transactional means through which consumers interact with a seller. Cash too. But most people tend to use their card when making purchases – either by entering a pin or, more recently, tapping to pay.

But now we all have phones, right? And now that we all have smartphones, surely it makes sense to have our cards “stored” inside our phone, stored safely and protected by layers of encryption and biometric security measures.

Well, that’s essentially what Google Pay is – And Apple Pay too.

Google Pay began life as a digital wallet (Google Wallet), then it developed into a P2P payment platform (Android Pay), before progressing into a fully-featured payment platform capable of running all your finances (Google Pay).

All you have to do to do is download Google Pay (you can do that here) and attach a credit card or a debit card to start using it – it’s really that simple.

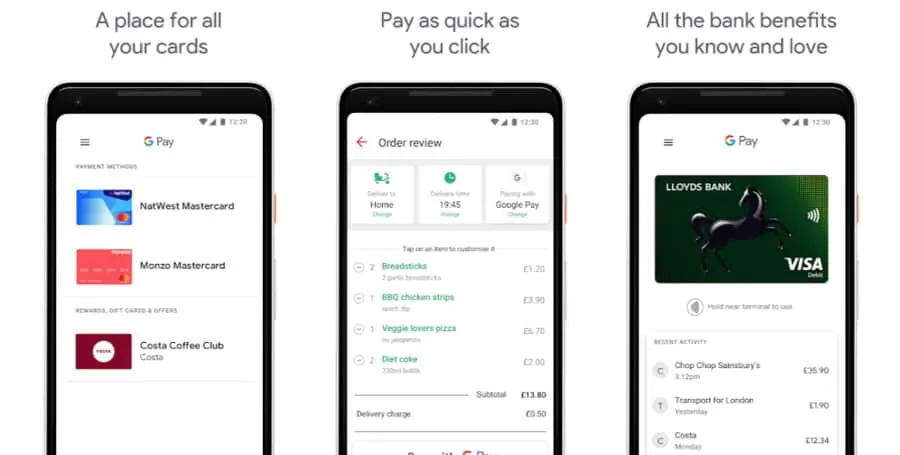

With a Google Pay, you attach your card – debit or credit card – to your account and you can then use Google Pay, rather than your card itself, to pay for things online, inside applications like Google Play Movies on your phone, for instance, and in brick and mortar stores.

It’s still your card making the payments, of course; it now just runs through Google Play, so you don’t need to have your card with you to make payments, or remember your pin, or enter your card details when you buy things online – all you need is your phone and, if you’re buying from somewhere new, your Google Pay log in details.

Here’s an example: Say you’re about to a new pair of sneakers from an online shop you haven’t used before. You add the sneakers to your basket and, when you come to pay for them, you remember you don’t have your card handy. 90% of the time there will be a Google Pay option available, simply click this, add in your Google Pay credentials, and make the payment.

Beyond this, Google Pay lets you use your phone as a card. You can pay for things by using tap to pay (contactless payments); it works in most stores and on public transport like buses, trams, trains, and the subway which is super-handy when you’re traveling abroad and you don’t want to be carrying around cash – or dealing with exchange rates.

Simple, right?

Is Google Pay Safe?

In many ways, Google Pay is actually safer than using your credit or debit cards. How so? When you use your card to pay for something in a store, you’re relying on that particular store having adequate protections in place that will keep your data and account safe. Most places do, of course, but there are always exceptions to the rule.

With Google Pay, you simply do not need to worry about this because all payments made using Google Pay are done through Google’s billion-dollar, super-secure servers. This ensures your payment information is always secure and never falls into the wrong hands.

You will also have to unlock your phone to make a purchase using Google Pay. When you do this, and a purchase is confirmed, Google will assign a temporary virtual account number with the merchant, not your real one, so that in the event that something does happen, your actual account details are not exposed.

This completely removes the potential for fraud, allowing you to shop with confidence. I know a lot of people worry about this kind of thing, people like my mum, but you really shouldn’t – Google is very, very, very good at security. Its servers are incredibly smart and have the most robust security measures in place to ensure nothing ever happens to your data.

On top of this, even if you lose your phone with an active Google Pay account running on it, you needn’t worry. First, it’s simple to get your phone locked down in the event that this happens. Second, your Google Pay account is protected by layers of security – from passwords to biometrics like your fingerprint and/or your face.

How To Keep Your Google Pay Account Safe

- Make sure you lock your phone – either with a fingerprint or facial scan

- Set up Find My Device, so you can wipe the phone if it is lost or stolen

- Only send money in Google Pay to people and businesses you know; never send money to strangers or weird people you’ve met online or in forums

- If you can, use a credit card for Google Pay – your account with then be covered under the credit card’s fraud protection policy

- Make sure all transactions in Google Pay require a pin or biometric scan

What Can You Do With Google Pay?

Here’s a full breakdown of everything you can do with Google Play:

- Tap and Pay (Contactless Payments)

- In-App Purchases

- Buy Products Online

- Option To Fill In Bank Details Automatically Inside Chrome

- Purchase Google Products – Phones, Apps, Accessories, Movies

- Send Money To Contacts (US & India only)

- Attach Gift-Cards, Coupons, Loyalty Cards & Tickets To Your Account

You can also store boarding passes and train tickets inside Google Pay, though not all airlines and train companies support Google Pay, so you’ll need to check that before you try and start adding tickets and boarding passes to your account.

To add a boarding pass or a ticket, or even a coupon or a loyalty card, simply open Google Pay and tap the “+ Pass” option and then follow the instructions. Once a pass is added, or a loyalty card, it will be associated with all the devices you run Google Pay on. And if you get a new phone, just download the Google Pay app and sign in and all your information will be where you left it.

Another awesome feature of Google Pay? It can pull in certain information from your Gmail account. For instance, say you booked a stay in a hotel, and the confirmation email is inside your Gmail account. Google Pay can then pull that information into the app for quicker and easier access, saving you the hassle of printing out check-in confirmations and what not.

Is Google Pay Available Everywhere?

Google Pay is available in the following countries:

- Australia

- Belgium

- Brazil

- Canada

- Chile

- Croatia

- Czech Republic

- Denmark

- Finland

- France

- Germany

- Hong Kong

- Ireland

- Italy

- Japan

- New Zealand

- Norway

- Poland

- Russia

- Singapore

- Slovakia

- Spain

- Sweden

- Taiwan

- Ukraine

- UAE

- The U.K.

- The U.S.

Which Banks Support Google Pay?

Google Pay is now supported by the biggest banks in the world.

Here’s a breakdown of all the USA banks that currently support Google Pay: American Express, Discover, MasterCard, and Visa. Bank of America, Capital One, Chase, Citi, Discover, PNC, US Bank, Wells Fargo.

And here’s all the UK banks that support Google Pay: Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA, Nationwide Building Society, and Natwest. Visa and MasterCard cards are also supported.

What Version of Android is Google Pay Available on?

Released in 2018, Google Pay is available on all Android phones that run Android KitKat (version 4.4) and above. If your phone is new, and it has NFC, you’ll be able to use Google Pay.

Please note: in order to use tap to pay (contactless payments), your phone will have to have an NFC chip built into it. Again, 99.9% of modern Android phones ship with NFC chips, so this should not be a problem.

What Devices is Google Pay Available On?

You can run Google Pay on Android, Wear OS, iOS devices like iPhone, as well as your desktop PC and laptop. With Android, you’ll want to download the Google Pay app and then follow the instructions to get started. It’s really simple too; you take a scan of your card with your phone’s camera, add in some security stuff, and you’re all set up – it takes about 30 seconds.

If you have a Wear OS smartwatch, you can add Google Pay on to it as well, so you can make payments using your watch instead of your phone. Your Wear OS device will need to have NFC, however, though 99.9% of Wear OS watches ship with NFC, so this shouldn’t be a problem.

Installing Google Pay on Wear OS Device

Google Pay comes pre-loaded on ALL Wear OS smartwatches and fitness trackers, so all you have to do is locate the app and open it.

Next, it will run through the setup process on the phone that your Wear OS device is connected to. You will be asked to verify some information to make sure it is you that is using the Wear OS device. Once you’ve done this process, which takes around 2 minutes, you will have Google Pay up and running on your smartwatch.

And once you’ve done that, you might want to take a look at all the awesome stuff you can do with Google Drive.