The 10 Best Fintech Apps To 10X Your Finances In 2024

If you want to get smarter with your money, saving or investments, you’ll want to check out these insanely useful fintech apps that’ll help you 10X your finances in 2024

Key Takeaways

Diverse Fintech Apps 📱:

- Fintech means Financial Technology and right now there is a massive array of fintech apps available for iPhone and Android users, catering to various financial needs, from crypto trading to automated investments.

Top Fintech Picks 🏆:

- Leading apps in the fintech space include Acorns, Venmo, Coinbase, and MoneyLion, each offering unique financial services.

Best Beginner-Friendly Choice 👶:

- Acorns stands out for its simplicity, making it an ideal choice for beginners. It effortlessly invests your spare change into stocks and ETFs.

Make Saving Money Effortless 💰:

- With Acorns, small amounts from daily transactions can accumulate into a significant saving over a year, all with zero effort from you. It is the perfect way to experience the wonderful world of compounding interest (where your existing money turns into more money).

Recommendation ✅: Acorns is highly recommended for its ease of use and effective saving method, suitable for everyone to try.

Next to getting a gym membership or starting to run, finance-related New Year’s resolutions are some of the most popular ones made (and broken) every single year.

But saving is hard, right? Ditto learning about the ins and outs of investing, either on the markets or with things like bitcoin.

And how are you supposed to start investing when you barely have enough money for a couple of glasses of wine after work on a Friday?

Simple: you defer to a higher power. Not god, obviously – although you could try that as well. No, I’m talking about leveraging fintech apps for your phone to make saving / investing / growing your money as painless as possible.

If you’re looking to get smarter with your money in 2024 and beyond, the fintech apps listed below should be on your radar. Oh, and “fintech” simply means financial technology in case you were wondering.

Best Fintech Apps Right Now

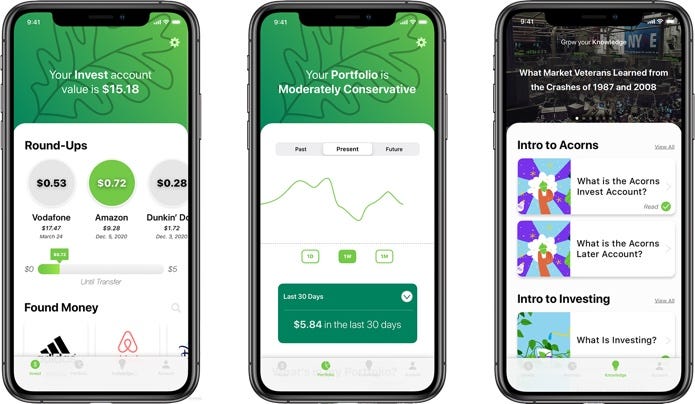

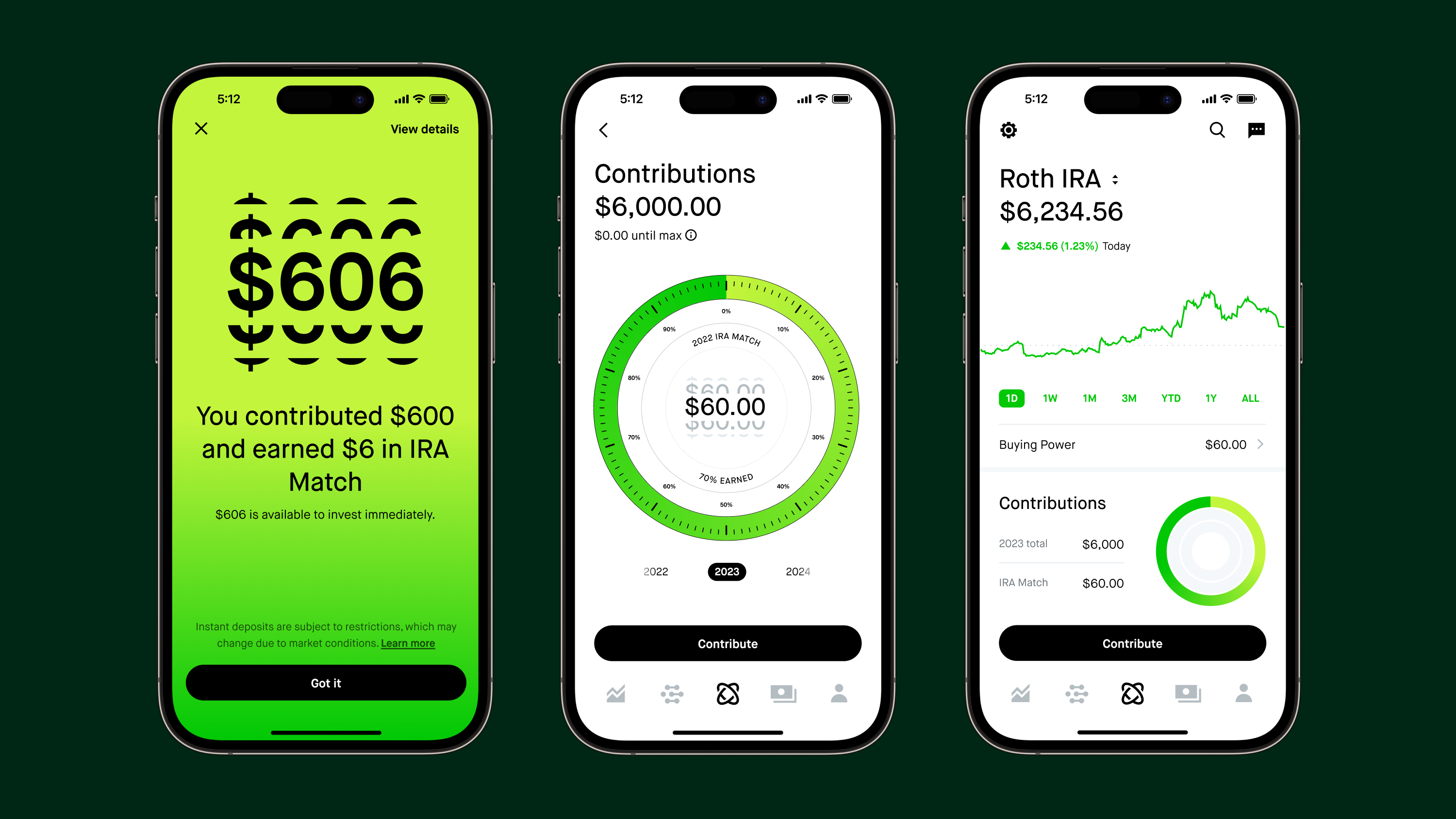

Acorns

Acorns is a brilliant fintech app that rounds up your everyday purchases and invests the spare change into a diversified portfolio of stocks and ETFs, helping you save and invest without having to think about it.

The app is only available in the US but if you’re in the UK and want to do similar stuff, the Plum app is the best alternative we have tested.

Who This is For:

- Those new to investing looking for an easy way to get started

- Hands-off investors seeking automatic contribution/investment

- People wanting to turn spare change into investment savings

- Those seeking diversified, pre-made investment portfolios

- Anyone wanting to effortlessly build an investment portfolio

Robinhood

A popular brokerage app that allows you to buy and sell stocks, ETFs, options, and cryptocurrencies without any commission fees. It offers a user-friendly interface and a wide range of financial instruments, making it ideal for beginners or those looking to start investing for the first time.

Who This is For:

- Active traders interested in commission-free trading

- Investors wanting an easy-to-use platform to manage portfolios

- Those interested in trading stocks, ETFs, options and cryptocurrencies

- Beginner investors seeking an intuitive introduction to trading

- People who want a modern, mobile-first trading experience

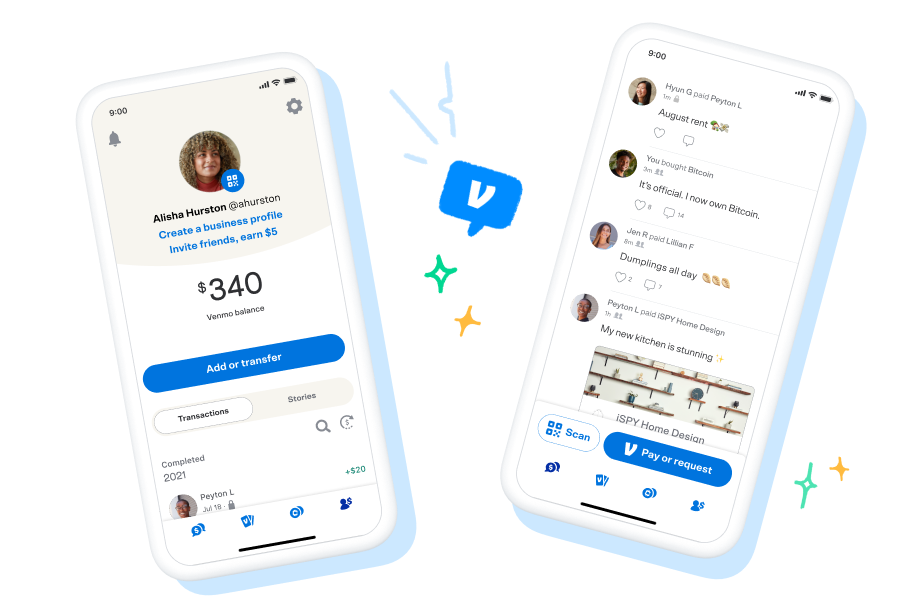

Venmo

Venmo is an ultra-popular mobile payment app that lets you send and receive money from friends, family, and businesses. It’s a convenient way to split bills, pay for shared expenses, and transfer funds quickly.

Who This is For:

- People who want an easy way to pay friends or family back

- Groups looking to split bills and expenses

- Those seeking a modern payment app with social features

- People wanting to pay small businesses directly from their phone

- Users desiring a streamlined money transfer experience

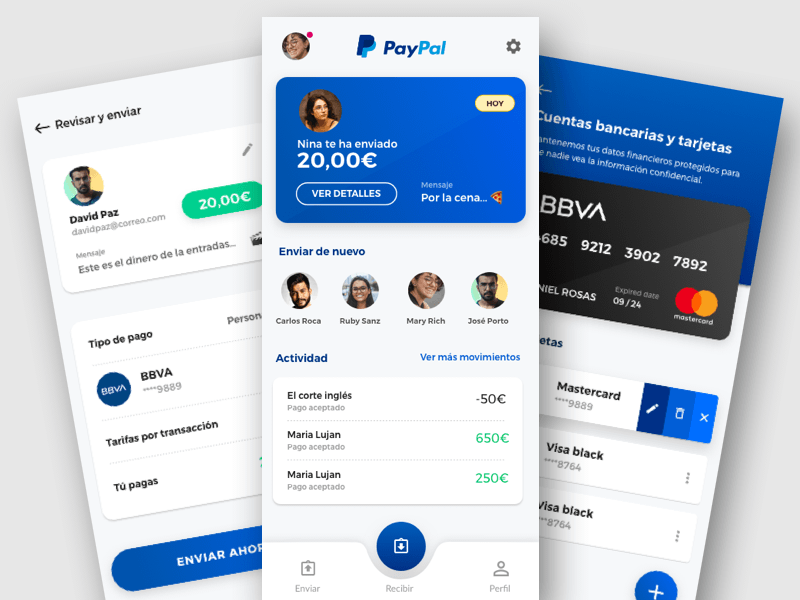

PayPal

Founded by Elon Musk and Peter Thiel, PayPal is one of the OG digital payment platforms. It is free to use and once installed you can use it to send and receive money, shop online, and manage your finances. It’s widely accepted for online transactions and offers buyer protection.

Who This is For:

- Online shoppers wanting payment protection and flexibility

- People needing to securely send or receive money digitally

- Small business owners looking to accept online payments

- Users wanting an all-in-one payment management platform

- Those desiring an established, trusted payment solution

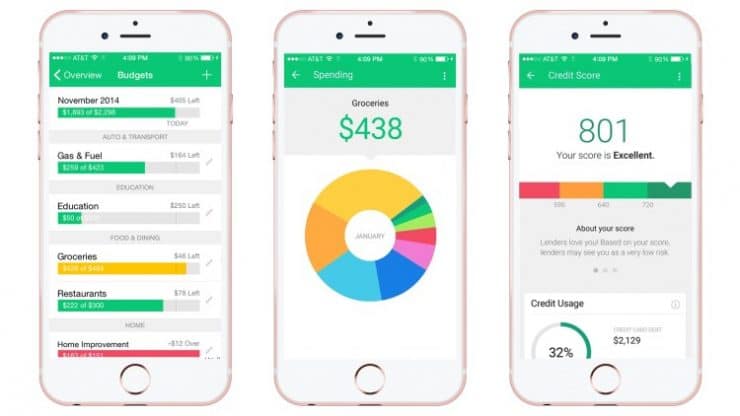

Mint

Mint is a personal finance management app that helps you track your income, expenses, investments, and debt. It provides insights into your spending habits and helps you create a budget to achieve your financial goals.

Who This is For:

- People wanting to easily track all their finances in one place

- Those looking to gain insights into spending habits

- Users interested in creating budgets and financial plans

- Individuals seeking tools to help reach money goals

- People needing help managing income, expenses, debt

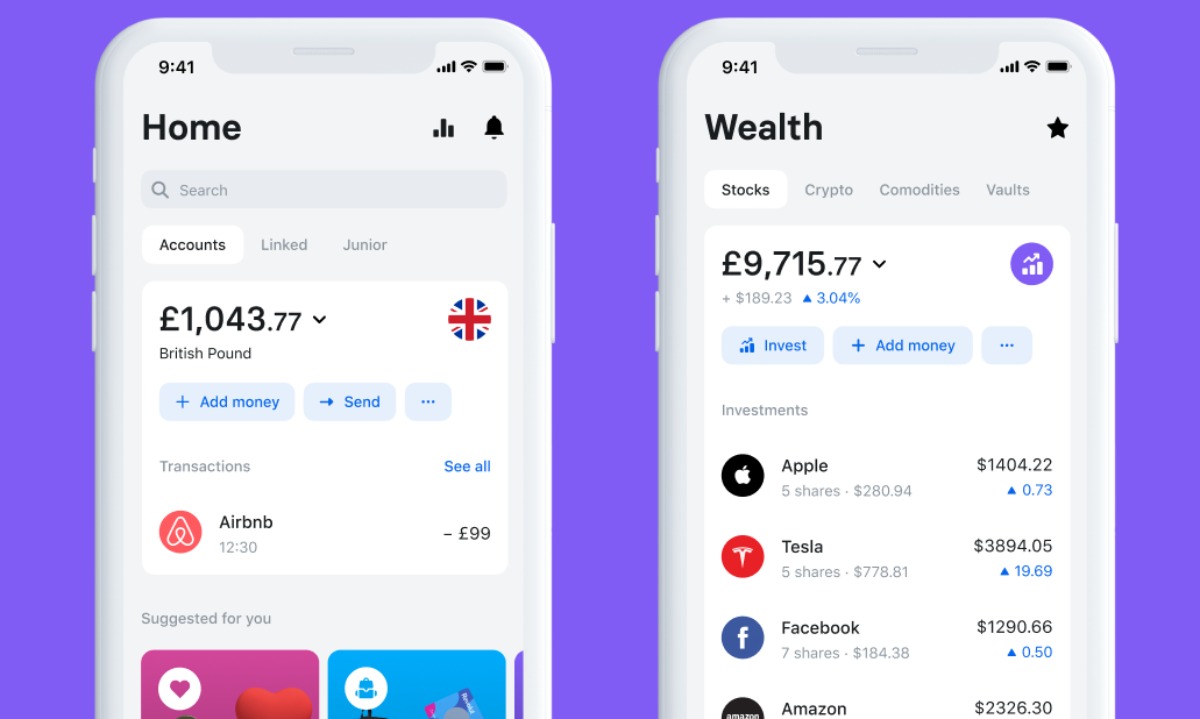

Revolut

Revolut is a multi-currency mobile banking app that allows you to manage multiple currencies, exchange money at competitive rates, and invest in a variety of assets. It also offers features like travel money, insurance, and bill payment services.

Who This is For:

- Frequent international travelers needing better exchange rates

- Those wanting to manage money in multiple currencies

- Investors seeking easy access to trading and investments

- People looking for innovative banking and money tools

- Users needing a one-stop shop for financing needs

Coinbase

Coinbase is perhaps the world’s most well known cryptocurrency exchange. You can join for free and once you’re set up you can buy, sell, and store a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. It provides a secure and user-friendly platform for crypto enthusiasts. And you can even get a wallet with Coinbase too.

Who This is For:

- Cryptocurrency investors looking for a secure exchange

- People new to crypto needing an easy on-ramp

- Traders wanting access to crypto pricing data and analysis

- Hodlers needing a safe place to store coins long-term

- Anyone seeking exposure to cryptocurrency assets

N26

N26 is a mobile banking app that offers a simple and transparent banking experience. It provides features like free international transfers, budgeting tools, and cashback rewards. If you’re looking to simplify your online banking experience, N26 could be well worth a look.

Who This is For:

- People dissatisfied with traditional bank experiences

- Those wanting modern banking tools in a mobile app

- Millennials looking for a digitally-minded alternative bank

- Frequent travelers needing free international transfers

- Users seeking banking with transparency and simplicity

MoneyLion

MoneyLion is a financial wellness app that combines personal finance tools, investment services, and credit building opportunities. It helps users manage their finances, grow their wealth, and improve their credit score.

Who This is For:

- People wanting an all-in-one financial solution

- Those needing help improving their credit score

- Investors seeking accessible wealth-building opportunities

- Individuals looking to better manage day-to-day finances

- Users interested in financial planning and education

You Need a Budget (YNAB)

YNAB is a budgeting app that is based on the principle that, to be financially free or secure, you have to spend less than you earn. Now, this is easier said than done, of course, but YNAB’s goal is to make it easier for people like me and you to get closer to doing this. It provides a four-step budgeting method and helps you track your income, expenses, and savings goals.

Who This is For:

- People struggling to stick to a budget

- Those wanting to gain control of their finances

- Individuals needing a structured budgeting approach

- Users interested in closely tracking spending

- Households looking to spend less than they earn

Which Type of Fintech App is Best For You?

One of the most important things when it comes to investing, saving, and growing your money is consistency. Things will go up and down but those that remain consistent, either with their saving or investing goals, tend to come out on top versus those that aren’t.

Of course, the best fintech app for you will depend on what you want to do with your money. And there are lots of different types of fintech apps available today.

The 10 Main Types of Fintech Apps & What They Do

- Digital Banking: These apps provide online-only banking services. They offer features like mobile check deposits and fee-free banking, exemplifying a shift from traditional to digital banking. Examples include Chime, Varo, and Ally Bank.

- Payments and Transfers: Apps in this category enable secure digital payments, including peer-to-peer transfers, bill payments, and contactless payments. Popular apps in this segment are PayPal, Venmo, Cash App, and Zelle.

- Investment Platforms: These platforms allow users to invest in various financial instruments like stocks, ETFs, and cryptocurrencies. They also provide robo-advisory services, making investing more accessible. Notable examples are Robinhood, Coinbase, and Wealthfront.

- Lending Solutions: Fintech apps in this area streamline the process of obtaining personal and business loans, featuring online applications and fast approval. Services like LendingClub, SoFi, and Kabbage have simplified the borrowing experience.

- Insurance Tech (Insurtech): Transforming the insurance industry, these apps offer digital policies, streamlined claims processing, and tools for comparing insurance options. Key players include Lemonade, Oscar Health, and Root.

- Regtech (Regulatory Technology): These apps assist financial institutions with compliance, risk management, and regulatory reporting, playing a crucial role in maintaining industry standards. Examples include ComplyAdvantage, Alloy, and Chainalysis.

- Personal Finance Management: Apps in this category help users with budgeting, expense tracking, and financial planning, offering insights into spending habits and overall financial health. Notable apps include Mint, YNAB (You Need a Budget), and Personal Capital.

- Real Estate Tech (PropTech): Innovating in the real estate sector, these apps cover services like property listings, homebuying platforms, and property management. Examples are Zillow, Redfin, and Airbnb.

- Crowdfunding: These platforms enable individuals and businesses to raise funds from a large pool of investors or donors. Platforms like Kickstarter, Indiegogo, and GoFundMe are prominent in this space.

- Blockchain and Cryptocurrency: Focusing on blockchain technology, these apps cater to digital currencies and decentralized finance (DeFi). Key names in this sector include Ethereum, Chainlink, and Aave.

- Peer-to-Peer (P2P) Lending: These apps facilitate direct connections between borrowers and lenders, offering competitive interest rates and a more streamlined borrowing process. They include user profiles, loan listings, and management tools to ensure secure transactions.

- Robo-Advisors: Providing automated investment advice and portfolio management, these apps use algorithms to create personalized investment strategies and optimize portfolio management. They make professional investment advice more accessible and affordable.

Why I Like Acorns App

Me? I’m no finance whizz or investment guru. Instead, I follow the advice of the great John C Bogle: Don’t look for the needle in the haystack. Just buy the haystack.

What does this mean exactly? Let’s break it down:

Don’t look for the needle (a particular stock and/or company) in the haystack. Just buy the haystack (meaning an Index Fund or ETF you can hold for years and decades).

With the Acorns app, I can do just this. I can pick and choose from a load of Index Funds and ETFs, assign how much I want to spend per month, and then just sit back and let Acorns do all the legwork.

Could I have done this manually? Of course. But I’d have failed miserably. Plus, even joining a traditional Index Fund like Vanguard – the fund Bogle himself founded – usually requires a ton of paperwork.

The logic here is simple: most beginners do not have the knowledge or expertise to buy individual stocks and build a portfolio themselves.

It takes years of applied experience and a penchant for consuming terabytes of financial reports (not fun). Or, you just defer to an app like Acorns which is designed to do all the hard work for you. It literally couldn’t be easier to use either: just sign up, add a credit or debit card, and start investing in ETFs and Index Funds.

Why Index Funds Though?

With Bogle’s approach to investing, Index Funds, you buy the ENTIRE market through an Index Fund or an ETF, contribute whatever you can afford on a monthly basis, and, overtime, you will start to reap the rewards of compounding interest.

Think of it this way: An index fund works by putting a little bit of money into many different companies.

It’s like having a piece of a lot of different businesses.

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund provides broad market exposure, low operating expenses, and low portfolio turnover. These funds follow their benchmark index regardless of the state of the markets.

Investopedia

If some businesses don’t do well, it’s okay because you have pieces of many other businesses that might be doing better.

This makes it safer than putting all your money into just one company.

So, an index fund is a way to spread out your money across many different companies, making your overall savings stronger and safer.

It’s like having a big mix of different coins in your piggy bank, making it more likely that your piggy bank will grow over time.

Acorns is a brilliant fintech app that rounds up your everyday purchases and invests the spare change into a diversified portfolio of stocks and ETFs, helping you save and invest without having to think about it.

- Simple To Use, Ideal For Beginners

- Invest Spare Change In Index Funds, ETFs, and Portfolios

- No Need For Big Investments, Just Small, Micro Amounts

- Available For iPhone / Android / Desktop