Key Takeaways: Acorns App – Your Pocket Investment Tool 🌱💼

- What: Acorns rounds up purchases to the nearest dollar and invests the spare change.

- How: Links to debit/credit cards for automatic round-up investments.

- Where: Acorns is only available in the USA. If you’re in the UK, Plum is the best alternative.

- Portfolios: Five types, from conservative to aggressive, based on risk tolerance.

- Accounts: Offers taxable accounts, IRAs, and custodial accounts.

Acorns Early: Investing in Children’s Future 👶🎓

- Feature: Custodial accounts to invest in children’s education and future.

Acorns Checking & Visa Debit Card 🏦💳

- Checking Account: No minimum balance, no overdraft fees, free ATM withdrawals.

- Debit Card: Cashback rewards at select retailers.

Bottom line? Over time, you’ll quickly accumulate cash in your savings. You’ll be surprised at how quickly it grows – small bits of change add up really fast. I used my savings to buy myself a shiny, new PRS baritone guitar last year.

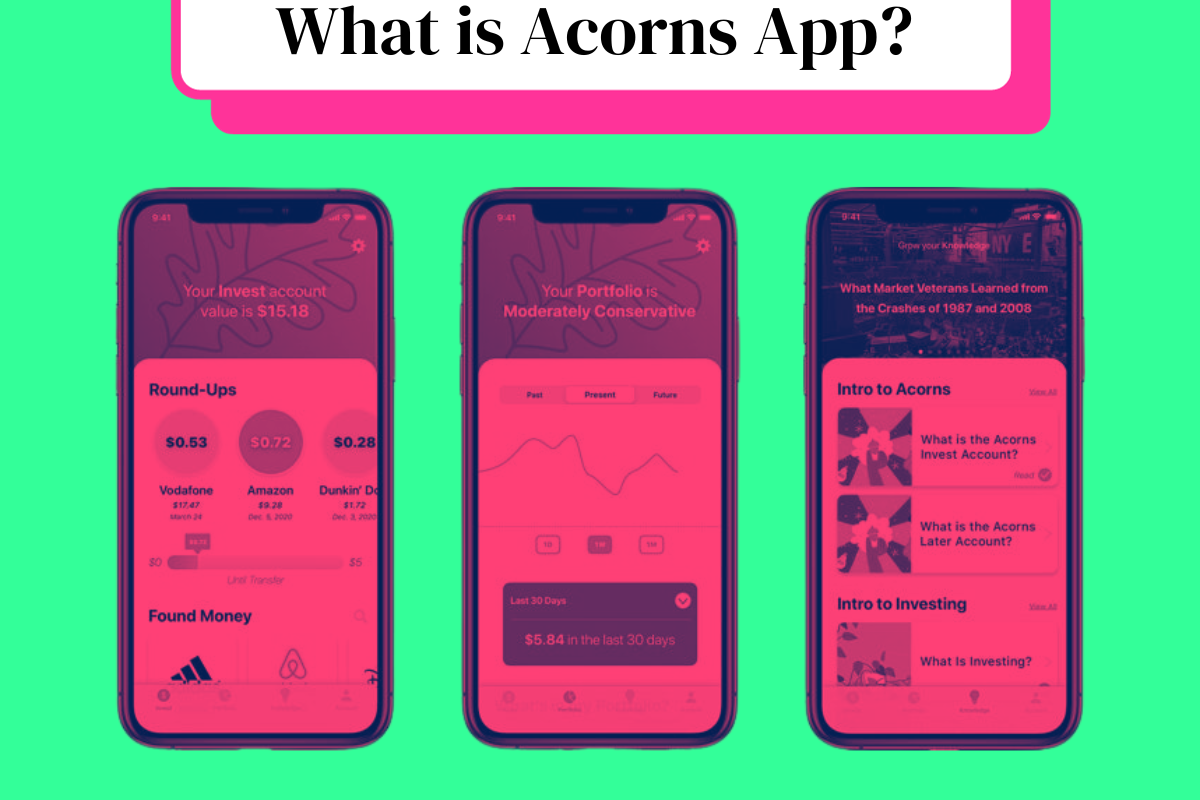

What is Acorns App? It’s A Micro-Investing App That Anyone Can Use…

Acorns is a popular micro-investing app that allows users to invest their spare change automatically. The app rounds up purchases made with linked debit or credit cards to the nearest dollar and invests the difference in a portfolio of ETFs (exchange-traded funds).

FYI –– A micro-investing app is a financial tool that allows users to invest small amounts of money, often by rounding up the change from everyday purchases and investing it into various financial instruments like stocks or exchange-traded funds (ETFs)

Acorns offers different investment accounts, including individual taxable accounts, traditional and Roth IRAs, and custodial accounts. Users can choose from five different investment portfolios, ranging from conservative to aggressive, based on their risk tolerance and investment goals.

Acorns also offers a feature called “Acorns Early,” which allows users to invest in their children’s future by opening a custodial account.

In addition to its investment features, Acorns also offers a checking account called “Acorns Checking” and a debit card called “Acorns Visa Debit Card.” The checking account has no minimum balance requirements, no overdraft fees, and unlimited free or fee-reimbursed ATM withdrawals. The debit card offers cashback rewards at select retailers.

Acorns also provides educational content and financial advice from experts to help users make informed investment decisions which is great if you want to learn more about micro-investing.

While Acorns has several competitors in the micro-investing space, its flat fee structure and user-friendly interface make it a popular choice for new investors looking to dip their toes into the world of investing.

However, it’s important to note that Acorns does not offer the ability to invest in individual stocks or cryptocurrencies like Bitcoin. You’ll need something like Coinbase for that kind of thing.

Overall, Acorns is a solid choice for those looking to start investing with a small amount of money and minimal knowledge of the stock market.

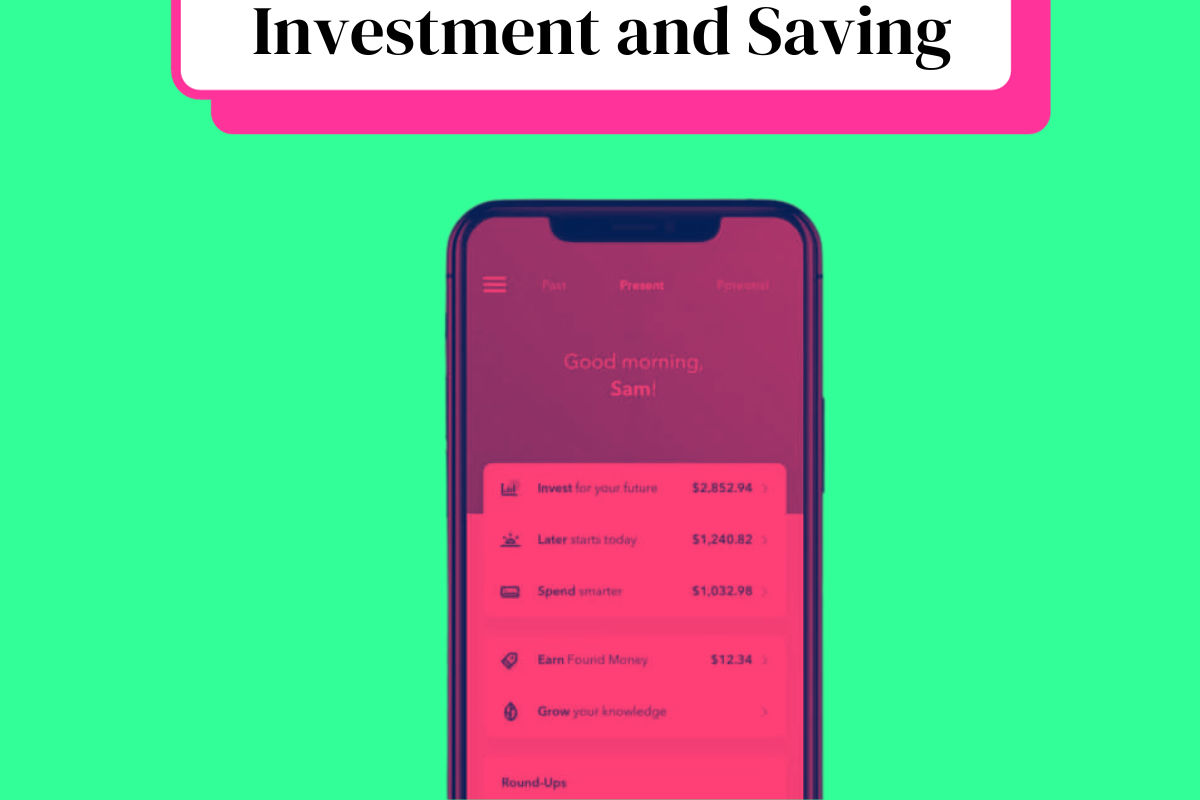

Investment and Saving with Acorns

Acorns is a popular investment and saving app that helps users to invest their spare change in a diversified portfolio of exchange-traded funds (ETFs). The app is designed to make investing easy and accessible for everyone, regardless of their financial goals or risk tolerance.

One of the key features of Acorns is its round-up feature, which allows users to invest their spare change from everyday purchases.

For example, if a user spends $3.50 on a cup of coffee, Acorns will round up the purchase to $4.00 and invest the extra $0.50 in the user’s investment portfolio. This feature makes it easy for users to save and invest without even thinking about it.

Acorns offers five different investment portfolios, each with a different level of risk and potential returns. Users can choose the portfolio that best suits their financial goals and risk tolerance.

The portfolios range from conservative to aggressive and are designed to provide diversification across different asset classes, including stocks and bonds.

Acorns charges a flat fee of $1, $3, or $5 per month, depending on the user’s account balance. This low-cost fee structure makes Acorns an attractive option for investors who are looking for a low-cost way to invest their money.

Acorns also offers recurring investments, which allows users to automatically invest a set amount of money on a regular basis. This feature is ideal for users who want to save for specific financial goals, such as a down payment on a house or a child’s education.

Overall, Acorns is a great option for investors who are looking for a simple and low-cost way to invest their money. With its round-up feature, diversified portfolios, and low fees, Acorns is a great choice for anyone who wants to start investing but doesn’t know where to begin.

Acorns App’s Features

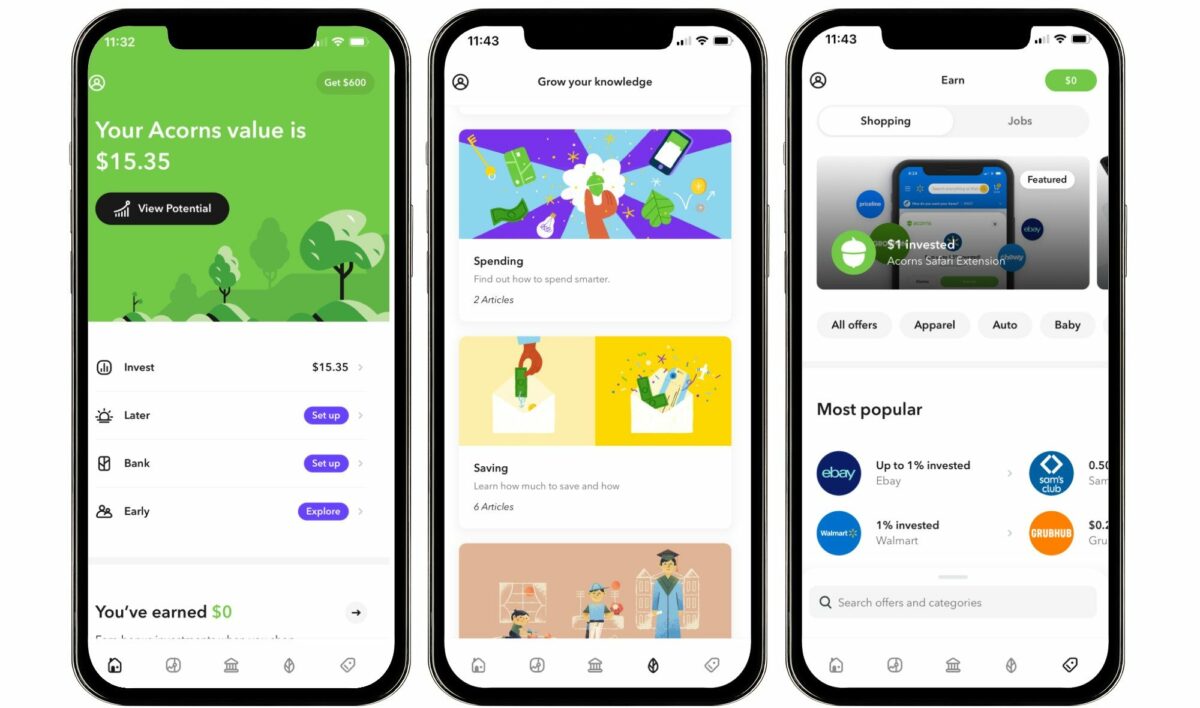

Acorns is a financial app that offers several special features to help users achieve their financial goals. Here are some of the features that Acorns offers:

- Round-Ups: Acorns offers a feature called Round-Ups that rounds up each purchase made with a linked card to the nearest dollar and invests the difference. This feature allows users to save money without even thinking about it.

- Recurring Investments: Acorns allows users to set up recurring investments, which can be weekly or monthly. This feature allows users to invest regularly and helps them build wealth over time.

- Expert-Built Portfolios: Acorns offers expert-built portfolios that are designed to help users achieve their financial goals. These portfolios are diversified and include a mix of ETFs from companies like Vanguard and iShares.

- Tax Advantages: Acorns offers potential tax advantages to users who invest in retirement accounts like IRAs. These accounts offer tax benefits that can help users save money on taxes.

- Acorns Checking: Acorns offers a checking account that is linked to the investment account. This account offers features like direct deposit, mobile check deposit, and digital card lock. It also has no overdraft fees and offers ATM fee reimbursements.

- Acorns Later: Acorns Later is a feature that allows users to invest in a diversified portfolio of ETFs designed for retirement. This feature allows users to save for retirement and take advantage of compound returns.

- Subscription Tiers: Acorns offers three subscription tiers: Lite, Personal, and Family. Each tier offers different features and benefits, like investment accounts for kids and ESG portfolios.

Acorns offers plenty of helpful features that can help you achieve your financial goals – even if it’s just saving a few quid every week. From expert-built portfolios to tax advantages, Acorns has something for everyone.

It’s dead easy to use as well, working in the background without you having to do anything. And it is completely free to get started as well.

Over time, you’ll quickly accumulate cash in your savings. You’ll be surprised at how quickly it grows – small bits of change add up really fast. I used my savings to buy myself a shiny, new PRS baritone guitar last year.

Acorns App FAQs

What are the benefits of using Acorn App?

Acorn App is a micro-investing app that helps users invest their spare change from everyday purchases. The app is designed to make investing accessible and easy for everyone, regardless of their financial knowledge or experience. By using Acorn App, users can start investing with just a few dollars and build a diversified portfolio over time. The app also offers features like automatic rebalancing, dividend reinvestment, and access to educational content to help users make informed investment decisions.

How does Acorn App work?

Acorn App works by linking to a user’s bank account and credit or debit card. When a user makes a purchase, Acorn App rounds up the transaction to the nearest dollar and invests the difference in a portfolio of exchange-traded funds (ETFs). Users can also make additional investments or set up recurring investments to grow their portfolio over time. The app charges a monthly fee for its services, which varies based on the user’s account balance.

What are the fees associated with Acorn App?

Acorn App charges a monthly fee for its services, which varies based on the user’s account balance. The fees range from $1 to $5 per month, depending on the plan selected by the user. The app also charges a fee for its investment portfolios, which ranges from 0.03% to 0.15% per year, depending on the portfolio selected.

Is Acorn App safe to use?

Acorn App takes security and privacy very seriously. The app uses bank-level security measures to protect user information and transactions. The app is also registered with the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA). This means that the app is subject to strict regulatory oversight and must adhere to strict standards of conduct.

Can Acorn App help me make money?

Acorn App is designed to help users invest their spare change and grow their wealth over time. While there is no guarantee of investment returns, Acorn App offers a range of investment portfolios designed to meet different investment goals and risk profiles. By investing in a diversified portfolio of ETFs, users can potentially earn returns over the long term.

What is the customer service like for Acorn App?

Acorn App offers customer support through its website and mobile app. Users can access a range of resources, including FAQs, educational content, and a help center. The app also offers phone and email support for more complex issues. Overall, the app has received positive reviews for its customer service and support.