What is Apple Pay? How does it work? Is Apple Pay safe? All of these questions and more will be answered inside this post, so read on for everything you need to know about Apple Pay…

In this comprehensive guide, we will cover everything you need to know about Apple Pay, from setting it up to understanding its security features. This article is designed for beginners and first-time Apple Pay users, so we’ve aimed to make it as helpful and easy to understand as possible.

Each section links out to a more detailed explanation. That way, if what we’ve covered on this page isn’t totally clear, you can click through to a more detailed user guide that covers the topic in broader terms.

By the end of this article, you’ll have a complete understanding of what Apple Pay is, how it works, why it is safe, and why it is better than traditional, plastic debit and credit cards.

Let’s do this!

What is Apple Pay?

Apple Pay is a mobile payment and digital wallet service for iPhone, Apple Watches, iPads, and Macs. With Apple Pay, you can make contactless payments in shops, bars, and restaurants as well as within apps and websites, making your transactions faster and more secure.

Apple Pay is available in over 78 countries globally which means you can travel abroad and, most of the time, use your iPhone and/or Apple Watch to make payments in shops, bars, and restaurants.

This is great news if you don’t taking your wallet out with you when you’re on holiday or traveling. All you need to pay for goods and services, in nearly every major country in the world, is your iPhone or Apple Watch.

As someone that has lost their wallet numerous times while abroad, this is a massive headache avoider for me. I can leave my wallet, which has my driving license and other important documents in it, in my hotel room and then I only have to worry about my iPhone.

And with the iPhone, if I do happen to lose it or it gets stolen, yes, it really does suck, but with things like Apple’s Find My app and the device’s incredible biometric security, even if it does fall into the wrong hands, the person will not be able to use the phone.

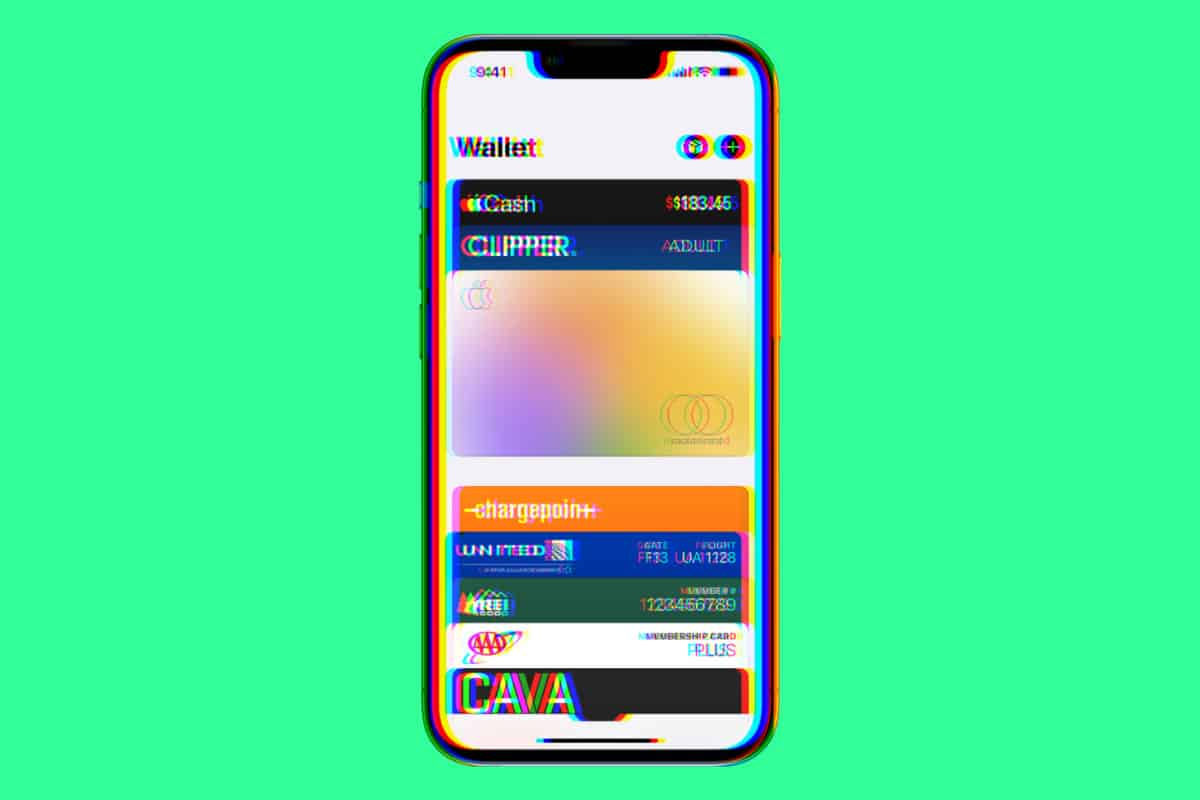

How To Set Up Apple Pay

To start using Apple Pay, you’ll first need learn how to get Apple Pay up and running on your iPhone, Apple Watch, iPad or Mac. Here’s a step-by-step guide for how to do it on iPhone and iPad:

- Open the Wallet app on your iPhone or iPad.

- Tap the “+” sign to add a new card.

- Follow the on-screen instructions to add your credit or debit card.

- Your bank or card issuer will verify your card. Once verified, you’re ready to use Apple Pay.

How to Use Apple Pay

Using Apple Pay is simple. When making a purchase at a store, just hold your device near the contactless reader and authenticate with Face ID, Touch ID, or your passcode. For online or in-app purchases, select Apple Pay as the payment method and complete the transaction using your device’s authentication method.

Apple Pay Limits

Contrary to popular belief, Apple Pay does have limits on the amount you can spend, and it varies by country and region. For this reason, it is essential to check first with your bank and then by your location before attempting to make a large payment with Apple Pay.

Here’s a handy table of all the different Apple Pay limits on a country-by-country basis.

Removing a Card from Apple Pay

If you need to remove a card from Apple Pay, follow these steps:

- Open the Wallet app on your device.

- Select the card you want to remove.

- Tap the three-dot icon in the top right corner.

- Scroll down and tap “Remove This Card.”

Verifying Apple Pay

To ensure the security of your transactions, you may be asked to verify Apple Pay when adding a new card or making a purchase. Verification methods can include a text message, email, or phone call from your bank or card issuer.

Apple Pay Express Transit

Apple Pay’s Express Transit feature allows you to use your iPhone or Apple Watch to pay for public transportation quickly and easily. To set up Express Transit, follow these steps:

- Open the Settings app on your device.

- Scroll down and tap “Wallet & Apple Pay.”

- Select “Express Transit Card.”

- Choose the card you want to use for transit payments.

Once set up, simply hold your device near the transit terminal’s contactless reader to pay for your mode of transport – no more travel cards!

Apple Pay Security

Despite the fact that Apple Pay is incredibly secure, plenty of users – my mom included – are worried about using Apple Pay. But they really shouldn’t be; Apple Pay is incredibly secure – like, insanely secure.

Apple Pay uses tokenization, which replaces your card details with a unique Device Account Number, ensuring your sensitive information is never shared with merchants. Additionally, transactions require authentication with Face ID, Touch ID, or a passcode, adding an extra layer of protection.

So, even if your iPhone is stolen the person that has it would not be able to make any payments using Apple Pay (or even access your iPhone) because of Apple’s market-leading biometric security features, like paying with a passcode or FACE ID.

Paying with a Passcode

In some cases, Apple Pay may prompt you to pay with a passcode instead of Touch ID or Face ID. This can happen if your device isn’t recognizing your fingerprint or face, or if you’ve restarted your device recently. Simply enter your passcode to complete the transaction.

Again, this is the type of security measure that ensures Apple Pay is completely secure. Even if someone could bypass FACE ID, they’d still need to your passcode. And when you’re dealing with four letter number combinations, it’d take them a good few hundred years to crack it.

Apple Pay Refunds

If you need to get a refund on Apple Pay, the process is quite simple. Most often, you can return the item to the store, and the merchant will process the refund to the card associated with your Apple Pay account. Keep in mind that refund policies vary by retailer, so it’s essential to understand their terms before making a purchase.

Apple Pay Supported Countries 2023

Here’s a complete list of all the countries where Apple Pay is available (as of 2023):

| Country | Is Apple Pay Supported? |

|---|---|

| South Africa | ✓ |

| Australia | ✓ |

| China mainland* | ✓ |

| Hong Kong | ✓ |

| Japan | ✓ |

| Macao | ✓ |

| Malaysia | ✓ |

| New Zealand | ✓ |

| Singapore | ✓ |

| South Korea | ✓ |

| Taiwan | ✓ |

| Armenia | ✓ |

| Austria | ✓ |

| Azerbaijan | ✓ |

| Belarus | ✓ |

| Belgium | ✓ |

| Bulgaria | ✓ |

| Croatia | ✓ |

| Cyprus | ✓ |

| Czech Republic | ✓ |

| Denmark | ✓ |

| Estonia | ✓ |

| Faroe Islands | ✓ |

| Finland | ✓ |

| France | ✓ |

| Georgia | ✓ |

| Germany | ✓ |

| Greece | ✓ |

| Greenland | ✓ |

| Guernsey | ✓ |

| Hungary | ✓ |

| Iceland | ✓ |

| Ireland | ✓ |

| Isle of Man | ✓ |

| Italy | ✓ |

| Kazakhstan | ✓ |

| Jersey | ✓ |

| Latvia | ✓ |

| Liechtenstein | ✓ |

| Lithuania | ✓ |

| Luxembourg | ✓ |

| Malta | ✓ |

| Moldova | ✓ |

| Monaco | ✓ |

| Montenegro | ✓ |

| Netherlands | ✓ |

| Norway | ✓ |

| Poland | ✓ |

| Portugal | ✓ |

| Romania | ✓ |

| San Marino | ✓ |

| Serbia | ✓ |

| Slovakia | ✓ |

| Slovenia | ✓ |

| Spain | ✓ |

| Sweden | ✓ |

| Switzerland | ✓ |

| Ukraine | ✓ |

| United Kingdom | ✓ |

| Vatican City | ✓ |

| Argentina | ✓ |

| Brazil | ✓ |

| Colombia | ✓ |

| Costa Rica | ✓ |

| El Salvador | ✓ |

| Guatemala | ✓ |

| Mexico | ✓ |

| Peru | ✓ |

| Bahrain | ✓ |

| Israel | ✓ |

| Jordan | ✓ |

| Kuwait | ✓ |

| Palestine | ✓ |

| Qatar | ✓ |

| Saudi Arabia | ✓ |

| United Arab Emirates | ✓ |

| Canada | ✓ |

| United States | ✓ |

[snippet]

Benefits of Using Apple Pay Over Physical Cards

Enhanced Security

One of the primary advantages of using Apple Pay is its strong security features. Apple Pay uses a two-factor authentication method that combines fingerprint scanning or facial recognition with a secure element chip. This chip generates a unique Device Account Number (DAN) for each transaction, eliminating the need to share your actual credit or debit card number with merchants. Additionally, Apple Pay transactions are encrypted, reducing the risk of data breaches and unauthorized access to your personal information.

Convenience

Apple Pay simplifies the payment process by enabling you to make transactions with just a tap of your iPhone, Apple Watch, or other compatible Apple devices. This eliminates the need to carry a physical wallet, and makes it easy to complete purchases in-store, online, and in-app. Furthermore, Apple Pay supports various credit, debit, and loyalty cards, providing a seamless payment experience for users.

Speed

Making payments with Apple Pay is quick and efficient. With its contactless payment technology, you can complete transactions within seconds, without needing to swipe or insert a card. This not only saves time, but also makes it easier to keep track of your expenses, as transactions are automatically recorded in the Wallet app.

Global Acceptance

Apple Pay has gained widespread acceptance across the globe, with millions of merchants and businesses accepting it as a mode of payment. This means you can use Apple Pay for transactions in numerous countries, making it an ideal payment solution for international travelers or those who frequently engage in cross-border transactions.

Easy Integration

Apple Pay can be easily integrated with various apps and websites, allowing you to make purchases without needing to manually enter your payment information. This simplifies the checkout process and makes it more user-friendly, providing an additional level of convenience for users.

Loyalty Programs and Rewards

Apple Pay supports various loyalty programs and reward cards, enabling you to earn points, miles, and other perks through your transactions. By storing your loyalty cards in the Wallet app, you can effortlessly access and manage your rewards, making it easier to take advantage of promotions and offers.

Eco-Friendly

By replacing the need for physical cards, receipts, and cash, Apple Pay promotes a more environmentally friendly payment process. This reduction in paper and plastic waste contributes to a greener future and aligns with the increasing global focus on sustainability.

![[REVEALED] The Real Reason You Can’t Use Apple Pay In Walmart [REVEALED] The Real Reason You Can’t Use Apple Pay In Walmart](https://www.knowyourmobile.com/wp-content/uploads/2023/12/Why-Walmart-Blocks-Apple-Pay.png)