In a move to enhance the utility of its digital wallet, Apple has introduced new features to the Wallet app, allowing users to view their account balances and transaction histories directly within the application.

This update, available for eligible card issuers, marks a significant step towards integrating more comprehensive financial information into the iOS ecosystem.

New Features at a Glance

The latest update enables users to:

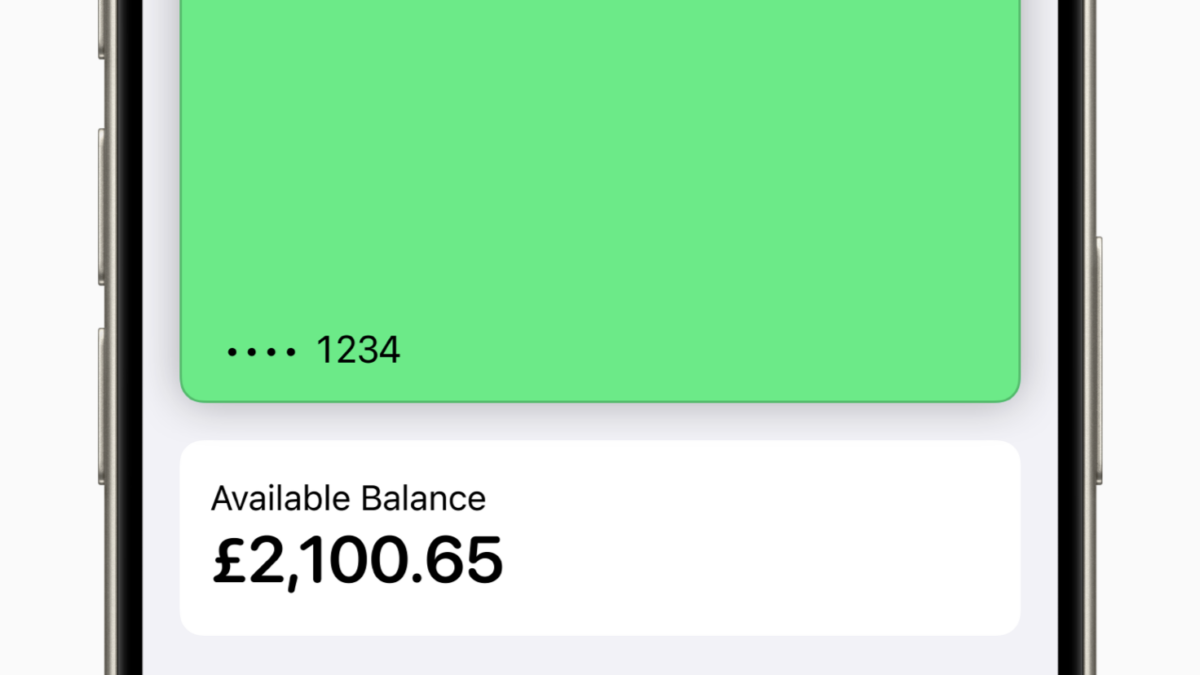

- View current account balances for connected debit or credit cards

- Access up to two years of transaction history

- See purchases made outside of Apple Pay

Availability and Eligibility

Currently, the feature is available in the UK for cards issued by major banks including Barclays, HSBC, Lloyds, and Santander, among others. In the US, a similar feature is accessible for Discover credit card users.

How to Use the New Features

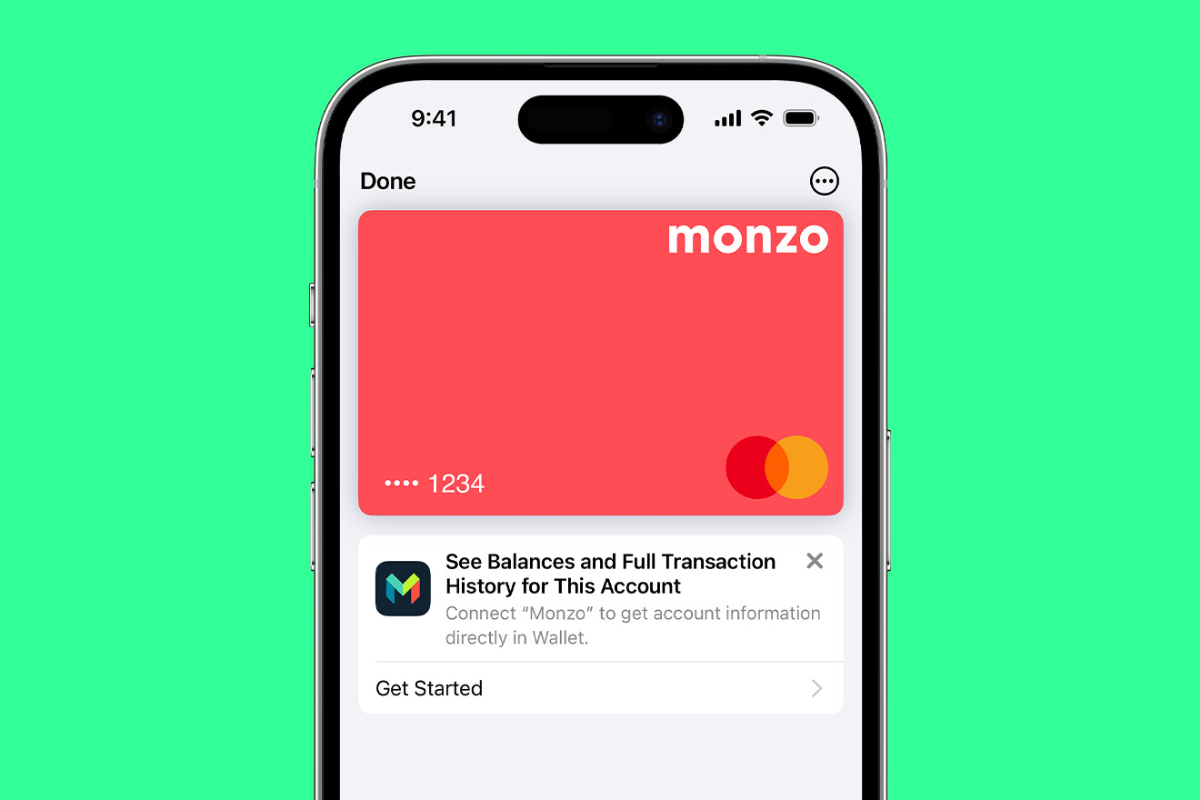

To take advantage of these new capabilities, users need to connect their accounts to the Wallet app. The process involves:

- Opening the Wallet app on an iPhone

- Selecting the card to connect

- Tapping “Get Account Balance & Activity”

- Following on-screen prompts to authenticate with the card issuer

Once connected, users can easily view their balance and transaction history by tapping on the connected card within the Wallet app.

Privacy and Control

Apple has implemented privacy measures, allowing users to turn off account activity tracking or disconnect their accounts entirely through the iPhone’s settings.

System Requirements

To use these features, users must have:

- iOS 17.1 or later on their iPhone

- The latest version of their banking app installed

Troubleshooting

For users experiencing difficulties, Apple recommends checking for service outages, ensuring internet connectivity, and verifying that their card issuer is eligible for the service.

This update represents Apple’s ongoing efforts to make the Wallet app a more comprehensive financial tool, potentially reducing the need for users to switch between multiple banking apps for basic account information.

Latest Apple Pay Coverage

View All →