Apple Pay provides a convenient way to make purchases using your iPhone instead of your debit or credit card – but can you obtain a refund if need be? Let’s investigate.

Table of Contents

Apple Pay has been around since 2014 with many iPhone users making immediate use of the mobile payment technology, however, there are still many people out there that are sceptical of it.

Many consumers still prefer to keep their banking and technological gadgets separate in an age where cyber security is a growing issue, with an army of hackers and fraudsters out there attempting to get their hands on our hard-earned money.

One topic of concern is whether or not it is possible to get a refund on purchases if the transaction was made using Apple Pay. So, are people right to be worried?

Can I Get A Refund Through Apple Pay?

Just as you would with any traditional payment type, you can very easily obtain a refund on purchases made through Apple Pay – the only information you may need in addition to a receipt with some merchants is your Device Account Number, which we’ll show you how to locate in this article.

In the majority of cases, you can just return items and get a refund using a standard store receipt just like you have always done before.

However, if you don’t have a receipt or a business has asked for further information, you’ll need your Device Account Number, which is payment card-specific. Again, this won’t always be the case, though.

Where To Find Your Device Account Number

Instead of the debit or credit card number from the physical card that you have linked to your Apple Pay, the merchant will use the Device Account Number of your payment card to process refunds for purchases made with Apple Pay.

Here’s how to find your Device Account Number on your iPhone:

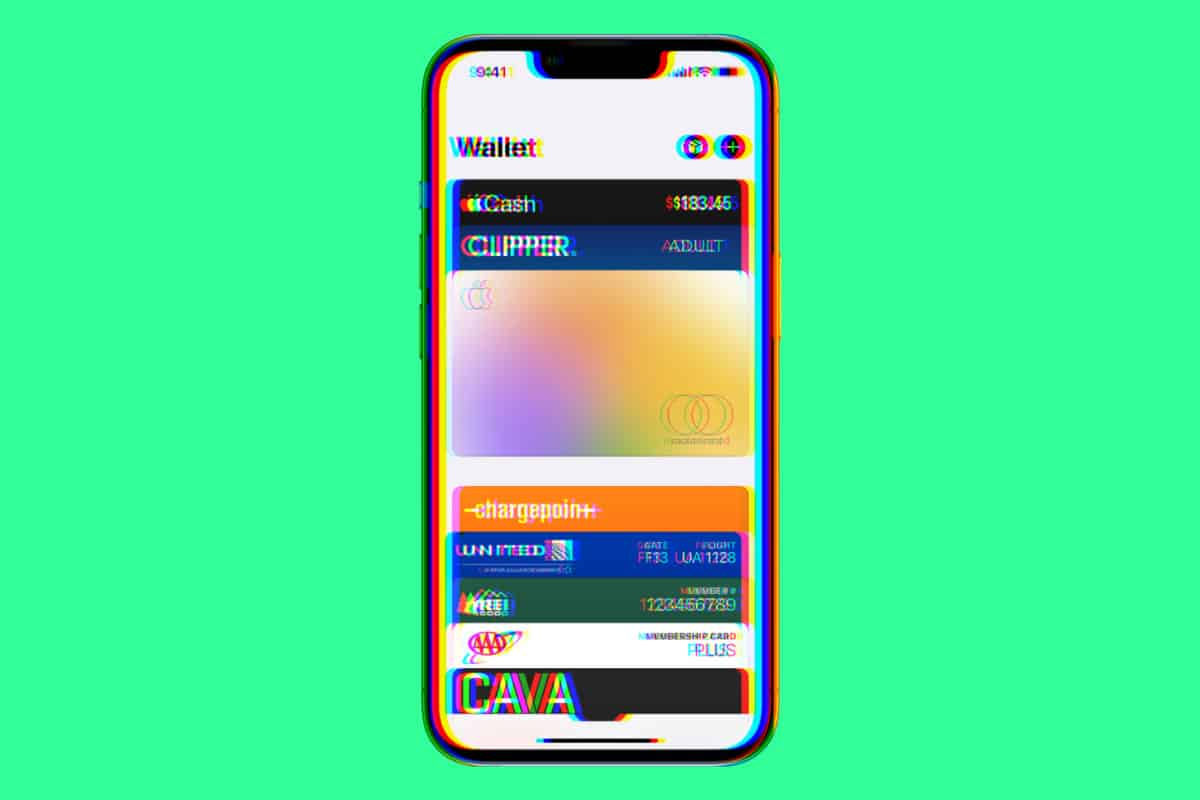

- Open the Wallet app on your iPhone.

- Tap the card that you used to make the refundable purchase.

- Touch the “More” button (button with three dots) to display the last four digits of your Device Account Number.

- You can also find your Device Account Number on your Apple Watch:

- Open the Wallet app on your Apple Watch.

- Tap the card that you used to make the refundable purchase.

- Scroll down to your card information which will show the Device Account Number for your payment card.

How To Get A Refund on Apple Pay

Now that you know where to find your Device Account Number, here’s how to use it to acquire a refund on a purchase you’ve changed your mind about or you’re not happy with:

- Provide the merchant with your Device Account Number if they require it.

- On the device that you used to make the purchase, open the Wallet application.

- Tap the card you used to make the purchase.

- Double click your iPhone’s side button and authenticate using your usual security method, whether that’s Face ID, Touch ID or just a passcode.

- Tap your phone on the merchant’s contactless reader.

As with any other refund type, it can take a few days for the payment to arrive back into your account.

Why You Should Be Using Apple Pay

When Apple Pay was initially launched in 2014, it appeared to be a ground-breaking concept that would take some time to catch on. Seven years later, over half of iPhone users are now using their phones to pay, with Google Pay, Samsung Pay and other new apps gaining traction on alternative devices, too.

1. Apple Pay Is Safer Than Plastic Cards

Going back to what we mentioned at the beginning of this article, there are many consumers out there that still prefer not to use mobile payment apps like Apple Pay as they do not trust the security, or maybe even themselves as they believe they could make a mistake or be tricked into making unintentional payments.

However, using apps like Apple Pay is actually more safe and secure than using even a standard debit or credit card as they require authentication from either your Face ID (facial recognition), Touch ID (fingerprint) or passcode.

2. Apple Pay Is Faster Than Plastic Cards

Once you’ve used contactless payments, you realise just how slow the Chip And Pin process really is. Although the limit for contactless may be slowly increasing over time and contactless cards may be the same speed as using mobile apps, the added security of mobile payments combined with the simplicity of use makes them the perfect payment option in almost any scenario.

Instead of digging through your pockets or handbag to pull out your wallet, searching through your cards to find the right one and realising you left it loose in a different pocket (not just me, right?), you can simply pull out your phone and hover it near the merchant’s contactless reader.

In fact, if you know the store you’re heading to accepts Apple Pay, you can just leave your wallet at home and have one less thing to worry about carrying around all day.

3. Apple Pay Is Available Almost Anywhere

When contactless systems initially came out, it felt like they were only available at a few chosen stores. Yes, they may have been the bigger stores and the ones you usually shopped at the most, but you were still likely having to pay with your credit or debit card the bulk of the time. This is no longer the case.

Thanks to Square and other modern payment machines that support contactless, not only have more national chains caught up, but smaller stores are also frequently offering the option as well.

Many apps and online businesses accept Apple Pay now, too, such as food delivery services like Uber Eats, online stores, coach, rail and flight ticket purchases and much more, so no more searching your house and car for your wallet when you’re rushing around.

And check out Why Does Apple Pay Say Pay With Passcode? And check out How To View Your Uber Rating!