It’s weird that a credit card is getting so much attention, but that’s what happens when it’s released by Apple. The iPhone maker officially launched the Apple Card this August and since then obtaining one is the latest tech status symbol you can have.

But just how do you go about applying for an Apple Card and how can you get approved? Read on.

What You Need To Get Approved For An Apple Card

The first step in getting approved for an Apple Card is making sure you meet the eligibility requirements before you apply. Here are the requirements Apple says you must meet. If you don’t meet these, then you will NOT have any chance of being approved.

- Be 18 years or older, depending on where you live.

- Be a U.S. citizen or a lawful U.S. resident with a valid, physical U.S. address that is not a P.O. Box. You can also use a military address.

- Own a compatible iPhone with the latest iOS version.

- Use two-factor authentication with your Apple ID.

- Sign in to iCloud with your Apple ID.

- If you have a freeze on your credit report, you need to temporarily lift the freeze to apply for Apple Card. Learn how to lift your credit freeze with TransUnion here.

- You might need to verify your identity with a Driver license or State-issued photo ID.

It goes without saying you’ll also need a fair to good credit score to be approved for an Apple Card. We’ve heard of people with credit scores as low as the 650s being approved, but the higher the score the better.

Here’s how FICO explains credit scores:

- <580 (Poor): This credit score is well below the average score of U.S. consumers and demonstrates to lenders that the borrower may be a risk.

- 580-669 (Fair): This credit score is below the average score of U.S. consumers, though many lenders will approve loans with this score.

- 670-739 (Good): This credit score is near or slightly above the average of U.S. consumers and most lenders consider this a good score.

- 740-799 (Very Good): This credit score is above the average of U.S. consumers and demonstrates to lenders that the borrower is very dependable.

- 800+ (Exceptional): This credit score is well above the average score of U.S. consumers and clearly demonstrates to lenders that the borrower is an exceptionally low risk.

Obviously the better your credit score, the lower your Apple Card APR will be. Apple Card APR’s currently range from 12.99% to 23.99% based on creditworthiness.

• TIP: Apple Card Savings Account: What You NEED To Know

How To Apply For An Apple Card

Applying for an Apple Card is pretty easy. Here’s how:

- Open the Wallet app on your iPhone (make sure you’re using the latest iOS).

- Tap the + button.

- Tap “Apple Card”.

- On the next several screens, fill out your first and last name, date of birth, phone number, home address, last four digits of your social security number, and your annual income.

- Next, Agree to accept the Apple Card Terms & Conditions.

- Within a few minutes, you’ll be notified in the Wallet app if you’ve been approved. If you have, the Wallet app will show you your credit limit and APR. To accept the offer, tap Accept Apple Card. NOTE: You have up to 30 days to accept your offer and your credit score is not affected until after you accept.

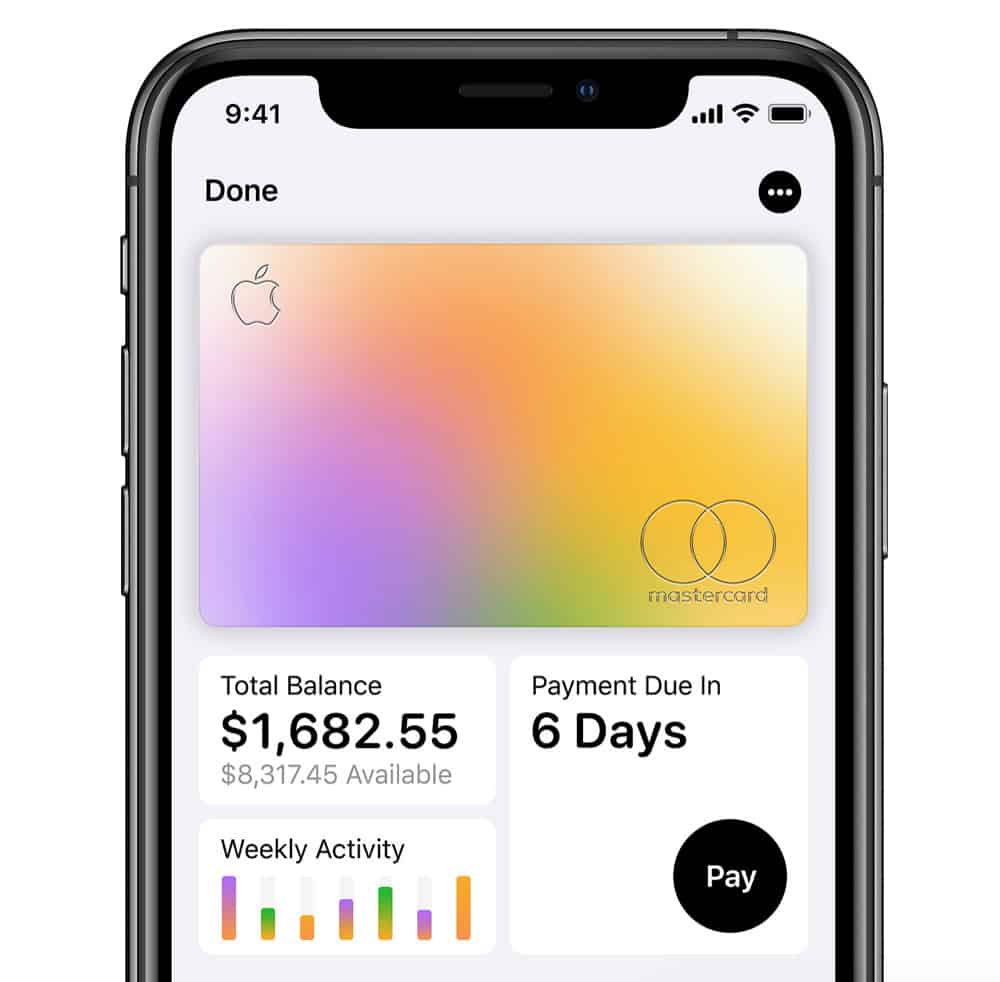

Once you accept your offer, the Apple Card is automatically added to your Wallet app and you can begin using it right away.

Check out How To Add Your Apple Account Card To iPhone Wallet App!