Here’s a complete micro investing 101, detailing everything you need to know about getting started and the best apps to use…

Back in the day, investing was controlled and dominated by investment firms and brokers. And then the internet and smartphones happened and now everyone is free to get their Warren Buffett on using a range of awesome fintech apps.

There’s still a massive barrier to entry for most people when it comes to getting started with investing – especially if you want to do it manually, picking and curating a portfolio yourself.

You need to know how to read financial reports, spot trends, and be aware of wider market trends. And have plenty of spare cash to burn. And even with all that in hand, people still get burnt by the markets.

A safer, more programmatic approach for the market-curious, for those of us that want a piece of the action without losing our shirts in the process, is micro-investing. But what the hell is micro investing?

What is Micro Investing?

Micro-investing is a financial strategy that’s changing the way we think about investing, especially for those without large amounts of capital. It involves saving small amounts of money – think of it as spare change – and investing these funds consistently into the markets through options like ETFs or fractional shares of stock.

Even a modest weekly sum, which might be just a few dollars, you can potentially grow a fairly substantial amount of money in as little as 12 months. Micro-investing democratizes financial growth, making the stock market accessible to a broader audience, not just the wealthy.

If you think you need reams of spare cash to start making gains from the markets, think again.

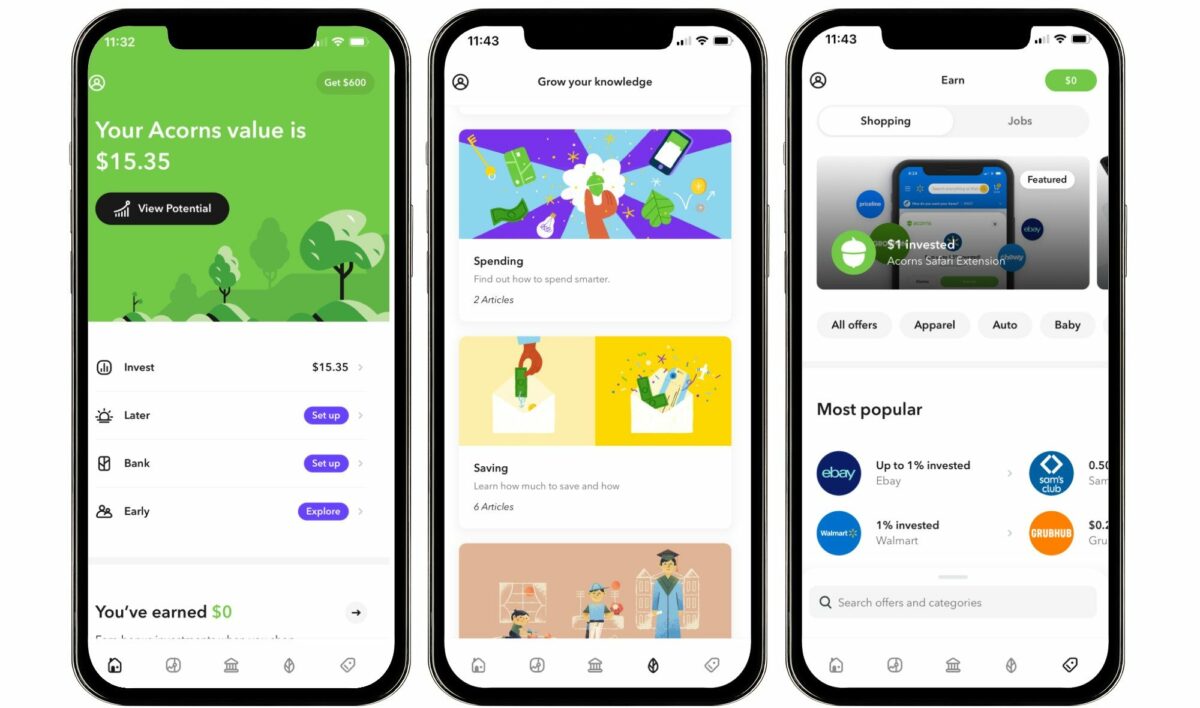

With micro-investing, you invest small amounts of money – as little as a few cents or a few dollars – regularly using specialised fintech apps (like Acorns, for instance).

Overtime, your investments grow. And, if you have a good spread inside some decent Index Funds or ETFs, your investments will start generating compound interest.

As the market goes up, the money you put aside and invested into the market does too.

Say you put $1,000 into a savings account with a 10% interest rate and the interest compounds annually. At the end of the first year, you will have $1,100. The initial $1,000 is your principal balance, plus you earn $100 in interest.

At the end of the second year, you will have $1,210—the $1,100 from the previous year, plus $110 in additional interest (10% of $1,100). Instead of calculating interest based solely only on your original principal, with compounding interest, the 10% applies to the principal plus accumulated interest.

By the end of the 10th year, you’ll have $2,594, more than double your initial savings—and you can thank compound interest.

Experian

And leveraging fintech apps to start growing your investments with minimal effort is the easiest way to do this. For instance, say you want to invest in the burgeoning AI industry.

You might not know who the key players are but with fintech apps like Acorns or Plum, you can pick a fund that targets companies in this niche.

Ditto for things like Big Tech, Big Pharma, Biogenetics – whatever.

This approach is perfect for those who aren’t ready to commit large sums of cash or are navigating their first investment steps.

Micro-investing platforms have effectively demolished typical barriers like high brokerage account minimums that excluded millions of people from benefiting from market investment.

Now, even with a few dollars or cents, you can start investing and growing your portfolio.

How Does Micro-Investing Work?

It’s straightforward. Platforms like Acorns, Plum, and Nutmeg allow you to invest tiny amounts regularly – amounts that might seem insignificant but can add up to a significant portfolio over time.

The process is usually automated (although most micro-investing apps let you buy individual stocks too), with funds being automatically transferred from your bank account to whichever app you’re using

And the best part? You’re not limited to singular stock purchases. There’s no paperwork, as there is with traditional Index Funds, and you can opt for fractional shares, mutual funds, and ETFs.

You don’t even need to know anything about the markets and/or the companies you’re invested in – the fund managers do all this for you. It literally couldn’t be simpler.

Bottom line? Micro-investing is something everybody should be doing, otherwise you’re just leaving money on the table.

An Example of Micro-Investing In Action

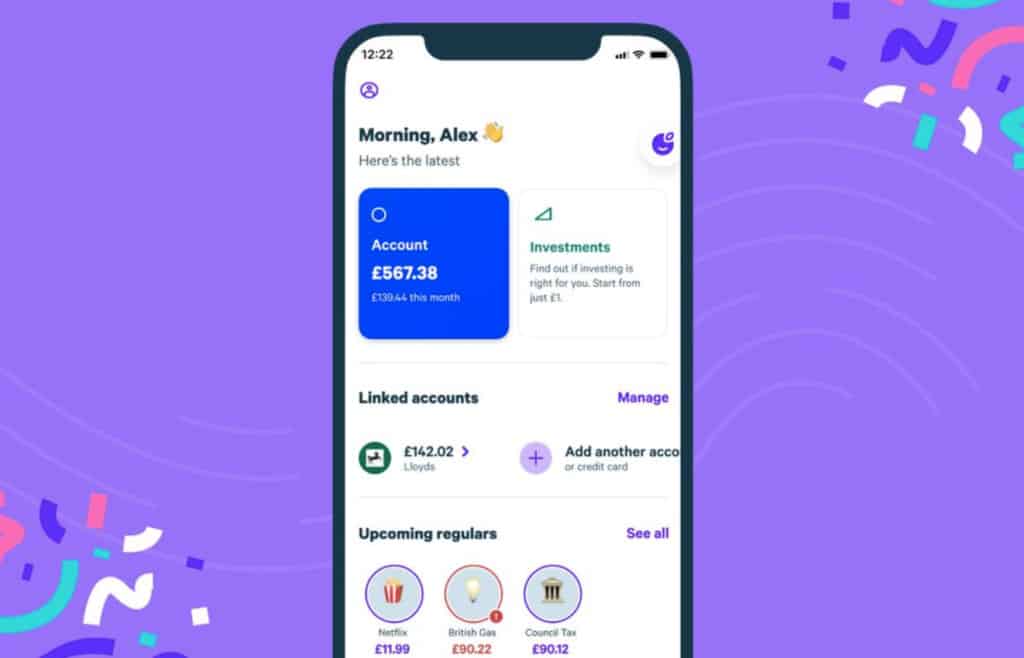

I’m based in the UK and while I do spend a fair amount of time in the US, I cannot access Acorns – it is US only. Instead, I use Plum which is a UK-alternative to Acorns that does much the same thing.

Within the Plum app, I’ve set up a split whereby 50% of my savings go into a savings account (a high-interest account) and the other 50% goes into my investment account.

In the investment account, I have a few companies that I invest in personally – Apple, Berkshire Hathaway, Mastercard, TSMC, etc – and a few managed funds that target niches I’m not too familiar with but know have huge growth potential.

Stuff like biotech, pharmaceuticals, and AI – all massive growth industries.

On average, I probably send around £100 to £150 into my investment account on Plum every month, and in the space of 18 months it has generated close to £3000 – not a bad return on investment.

And the best part? I didn’t even notice the money coming out of my account. Plum – and Acorns – use a system whereby spare change, so £0.30 from a £2.70 purchase, for example, is moved into the app and split across my channels (savings and investments).

Now, £0.30 might not sound like a lot but when you’re doing this every time you make a transaction, it quickly adds up and, for the most part, it is completely painless – you don’t even notice the money disappearing from your account.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it. – Albert Einstein

Add in compounding interest, whereby your money grows, accruing interest as time passes, and your finances will be looking better in no time whatsoever.

Pros and Cons

OK, we’ve covered most of the basics around getting started with micro-investing. But it cannot be all sunshine and unicorns. There are, of course, pros and cons to any kind of investment strategy.

So, I’d be doing you a disservice if I didn’t highlight both the PROS and CONS of micro-investing.

Advantages of Micro-Investing

- Start with a Little: You can begin investing with just a few dollars. This is perfect if you don’t have much money right now.

- Spread Your Risk: By investing in things like ETFs (which are like baskets of different stocks), you can spread your risk, even with a small amount each month.

- Every Penny Counts: Small amounts, like spare change, can grow over time. This can turn into a lot of money after many years.

- Automatic and Easy: Micro-investing apps can automatically take a small amount of money and invest it for you. This helps you keep saving without thinking about it.

- Build Good Habits: It’s a great way to start saving regularly, even if it’s just a little bit at a time.

Disadvantages of Micro-Investing

- Not Enough for Retirement Alone: Micro-investing is a good start, but it’s probably not enough to fund your entire retirement. You’ll need to save more, like in a retirement plan at work or in an IRA.

- Save More than Just Change: To really prepare for things like retirement, you should aim to save more, like 10-20% of your income.

- Watch Out for Fees: Some micro-investing apps charge monthly fees. If you’re only saving a little, these fees can take a big chunk of your investment.

As you can see, for the most part, the PROS well outweigh the CONS in this context. There are some salient points, however, that are worth considering.

Micro-investing is NOT going to make you rich quickly but it is great for accumulating fairly decent-sized chunks of money over 12 and 24 month periods.

A pension or an IRA, whereby large sums of money are invested upfront will always be more appropriate for retirement, but for smaller things (holidays, saving up for a wedding or a deposit for a house), there’s plenty of reasons to start micro-investing.

I’ve used the funds generated by my Plum account for everything from buying new guitars to Xmas gifts. It’s super-handy to know that, whatever happens, I always have a couple of grand laying around to fall back on.

My advice? Get started today and in 12 months time you’ll have a very big smile on your face. Acorns is free to use and very simple as well – you can get an account today right here.

This is a basic overview of how micro-investing platforms like Plum and Acorns work. For more information on the nuances of fintech apps and Acorns, check out the resources below: