Key Takeaways

- Truth Social’s user base is 88% Republican, 85% American, and mostly over 55 — not a recipe for mainstream growth

- Monthly active users are estimated between 2–6 million, with very poor retention

- Nearly half of users abandon the app within 60 days

- The platform lost $327M in Q1 2024 and is not generating meaningful ad revenue

- Investor interest is shrinking, and the stock is down significantly from IPO highs

Three years after its launch, Donald Trump’s Twitter alternative is still limping along with low user counts, minimal engagement, and massive financial losses. If you’ve been wondering whether Truth Social is working out, the short answer is: no. Here’s the data that proves it.

Truth Social’s User Base Is Extremely Niche

Truth Social has one of the most politically and demographically narrow user bases of any major social platform.

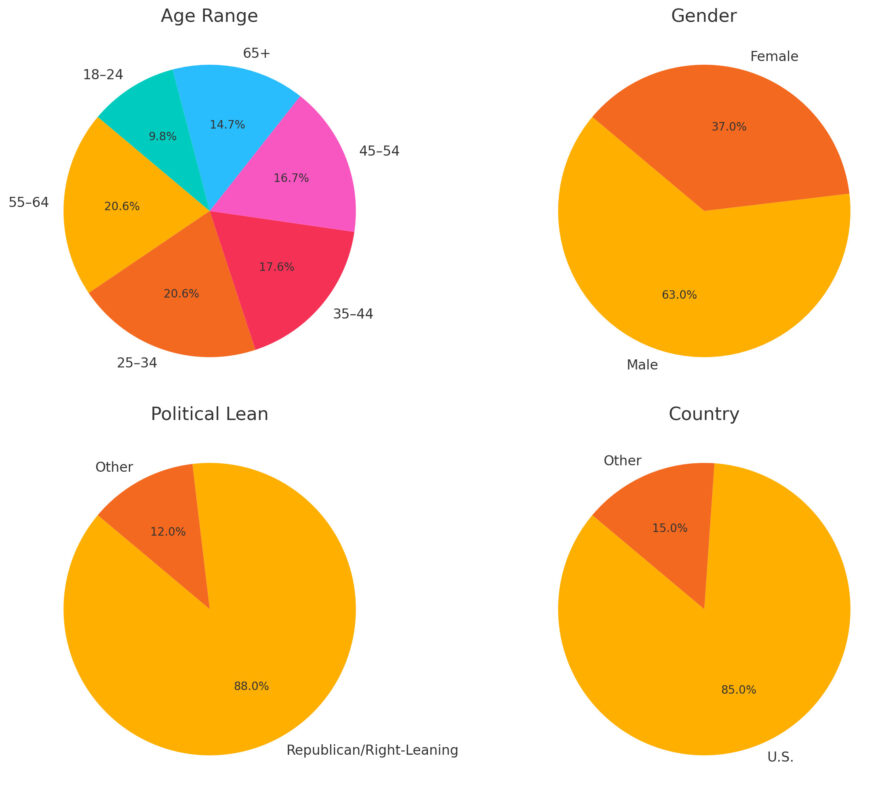

📊 2025 User Demographics:

- 88% of users are Republicans or right-leaning independents

- 84–85% are based in the United States

- 60% are male

- 65% are over 55 years old

- Only around 10% of users are aged 18–24

The typical user: A conservative, middle-aged or older American man using the platform for political content aligned with Trump-era talking points.

That’s a very small niche in the wider social media ecosystem, especially considering younger users (18–34) are typically the most active online. On Truth Social? Most of them aren’t even interested.

- Half of U.S. adults aged 18–34 say they’d never consider using the platform.

That lack of generational reach is a huge problem for long-term growth and for attracting advertisers.

Truth Social’s Growth Has Already Peaked

Compared to mainstream platforms like X (formerly Twitter), Facebook, or Instagram, Truth Social is minuscule.

📉 2025 Monthly Active User Estimates:

- Low estimate: ~2 million

- High estimate: ~6.3 million

- 2024 peak: 13.8 million (March, during Trump-related news)

- 2024 low: 2.1 million (June)

The traffic spikes during major political events.

But retention is terrible:

- 49% of users stop using the app within 60 days

- Most users log in less than 2 days per week

Even though the app has been downloaded 4.36 million times, there’s very little stickiness meaning people try it and quickly leave.

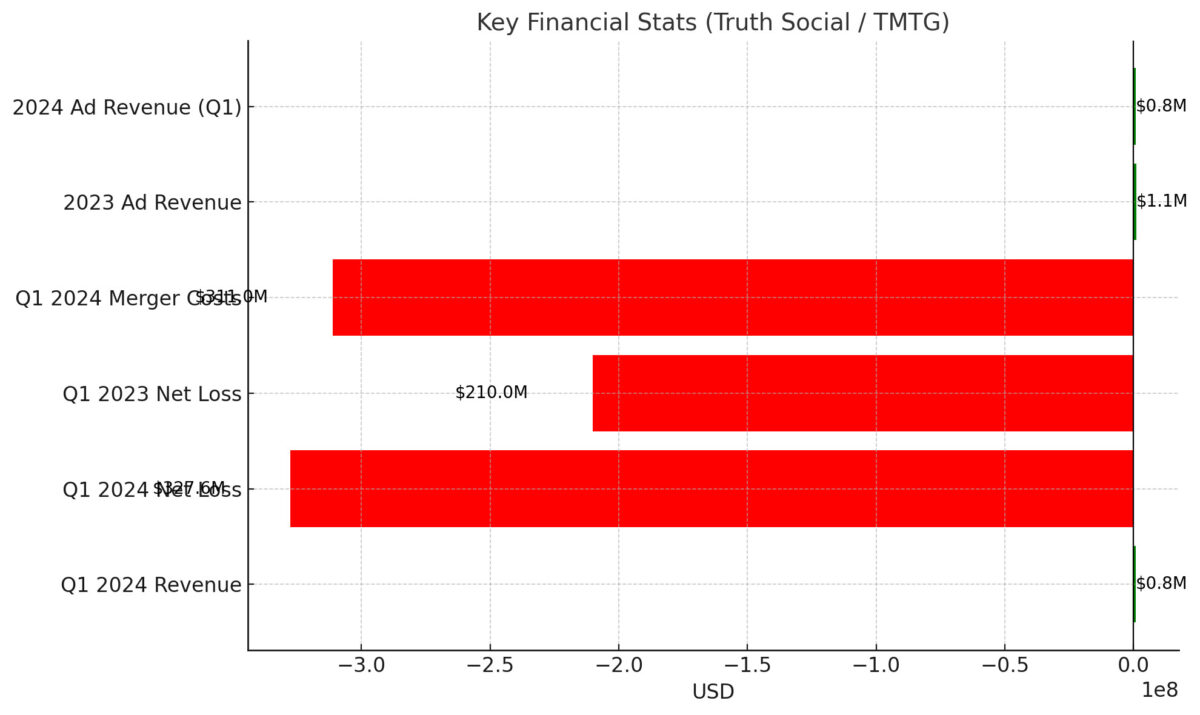

Financials: Truth Social Is Burning Cash

Behind the scenes, Truth Social is hemorrhaging money. Its parent company, Trump Media & Technology Group (TMTG), is posting enormous losses.

💸 Key Financial Stats:

- Q1 2024 Revenue: ~$770,000

- Q1 2024 Net Loss: $327.6 million

- Includes $311 million in non-cash expenses from its SPAC merger

- Q1 2023 Net Loss: $210 million

- Ad Revenue in 2023: ~$1.1 million

- Ad Revenue Q1 2024: Down to $770K

That’s next to no income for a social network trying to scale. It’s hard to imagine a path to profitability without massive changes in user growth or ad performance — neither of which are happening.

Market Valuation Has Collapsed

Truth Social went public in March 2024 through a high-profile SPAC merger. The initial hype was huge.

- Stock symbol: DJT (Donald J. Trump)

- Peak stock price: ~$80/share

- 2025 stock price: Under $50

- Current valuation: Hundreds of millions, down from $3–4 billion estimates

Early investor excitement has fizzled out, and the company is now worth a fraction of what was originally promised.

Is Truth Social a Failure?

At this point, the answer is obvious. Truth Social is not a mainstream success — it’s a siloed, stagnant, and financially shaky platform stuck catering to a small, aging political echo chamber.

It hasn’t grown, it isn’t profitable, and it isn’t appealing to new users.

Truth Social is proof that just because you can build a social network doesn’t mean you should.

For now, it remains Donald Trump’s Twitter clone: smaller, older, and on very uncertain footing.