- Apple’s Services Business: A Money Machine

- 1. The App Store: Apple’s 30% Cut

- 2. Subscriptions: Apple’s Recurring Revenue Machine

- 3. iCloud+ & Storage: The Hidden Money Maker

- 4. Apple Pay, Apple Card & Financial Services

- 5. Advertising: Apple’s “Secret” Business

- 6. Licensing Deals: Google’s $20 Billion Search Payment

- 7. AppleCare & Repairs: Premium Protection Plans

- Why Apple’s Services Business Matters

Apple isn’t just a hardware company anymore. Sure, it still makes iPhones, iPads, Macs, and Apple Watches, but an increasingly large chunk of its revenue comes from services—things like subscriptions, the App Store, and financial products.

In Q1 FY25, Apple’s services business alone generated $26.3 billion—up from $23.1 billion last year. That’s nearly 20% of Apple’s total revenue ($124.3 billion).

Services are way more profitable than hardware because they don’t require factories, supply chains, or materials like lithium and silicon.

Even more importantly, Apple’s services cost of sales was just $6.57 billion, meaning the company had an insane 75% gross margin on services—way higher than hardware margins.

This is why services have become a core focus for Apple’s long-term strategy.

Apple’s Services Business: A Money Machine

Apple’s services revenue comes from a few key areas:

1. The App Store: Apple’s 30% Cut

Every time you buy an app, pay for a subscription (like Spotify or Tinder), or make an in-app purchase (Fortnite skins, anyone?), Apple takes a 15-30% cut. The App Store is a massive revenue driver because Apple essentially acts as the gatekeeper for over 2 billion active devices.

💰 Revenue Source:

- App purchases

- App Store Search Ads (developers pay for placement)

Financial Impact: While Apple doesn’t break out App Store-specific earnings, its overall services revenue grew by $3.2 billion year-over-year—much of this coming from App Store commissions and ads.

2. Subscriptions: Apple’s Recurring Revenue Machine

Apple has built an entire subscription empire, covering everything from music to news.

📺 Apple TV+ – A competitor to Netflix with exclusive shows and movies

🎵 Apple Music – A music streaming service competing with Spotify

🕹️ Apple Arcade – A gaming subscription with 200+ ad-free games

📰 Apple News+ – A digital magazine and newspaper service

🏋️ Apple Fitness+ – Workout videos tied to Apple Watch

Then there’s Apple One, a bundle of all these services—a genius move that keeps users locked into Apple’s ecosystem.

💰 Revenue Source:

- Subscription fees

- Apple One bundles

Financial Impact: Apple’s services segment grew faster than any other category in Q1 FY25, proving that subscriptions are a major driver of revenue growth.

3. iCloud+ & Storage: The Hidden Money Maker

Apple offers 5GB of free iCloud storage, which fills up very quickly. If you want to back up photos, videos, and messages, you have to pay for more storage.

📦 iCloud+ Plans:

- 50GB – £0.99/month

- 200GB – £2.99/month

- 2TB – £8.99/month

Plus, Apple’s AI features (Apple Intelligence) will require iCloud storage in the future—driving even more revenue.

💰 Revenue Source:

- iCloud+ subscriptions

- Extra storage upgrades

Financial Impact: With 2 billion active Apple devices, even a small percentage upgrading iCloud storage translates to billions in annual revenue.

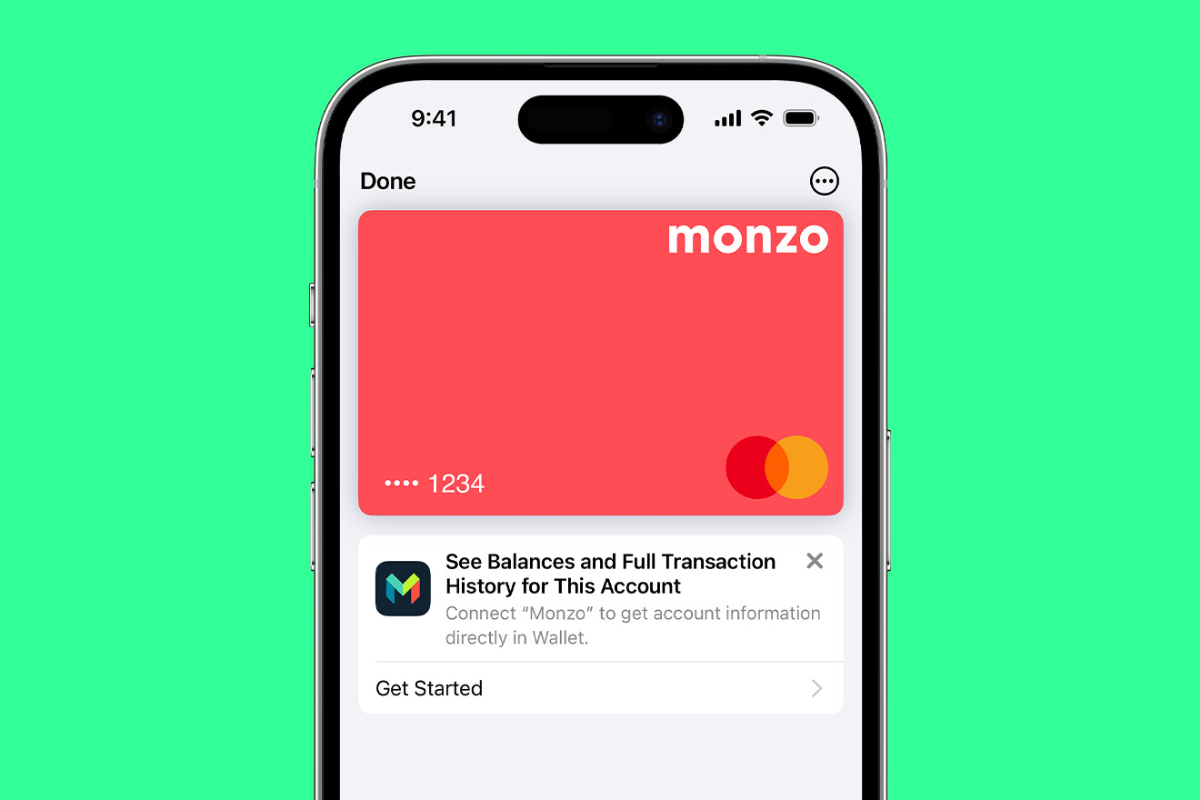

4. Apple Pay, Apple Card & Financial Services

Apple doesn’t just make money from selling gadgets—it also profits from your transactions.

💳 Apple Pay – Apple charges merchants a small fee every time you use Apple Pay

💰 Apple Card – Apple earns money from interest, fees, and cash-back incentives

📈 Apple Pay Later – Apple’s Buy Now, Pay Later service generates income from financing

💰 Revenue Source:

- Transaction fees

- Interest on Apple Card balances

Financial Impact: Apple doesn’t break out revenue from Apple Pay or Apple Card, but its services category includes billions in transaction fees, especially as Apple Pay adoption continues to grow globally.

5. Advertising: Apple’s “Secret” Business

Apple doesn’t sell your data, but it makes a fortune from ads inside its ecosystem.

📱 App Store Search Ads – Developers pay Apple to get their apps seen

📰 Apple News & Stocks ads – Apple shows paid ads inside its News and Stocks apps

🗺️ Apple Maps ads – Businesses pay for promoted locations in Maps

💰 Revenue Source:

- App Store ads

- Ads inside Apple News, Stocks, and Maps

Financial Impact: With millions of developers competing for attention, App Store search ads have become a key growth area for Apple’s ad business.

6. Licensing Deals: Google’s $20 Billion Search Payment

Google pays Apple a staggering $15-20 billion per year to remain the default search engine in Safari. This is essentially free money for Apple.

💰 Revenue Source:

- Google’s payment for Safari search default

Financial Impact: This is one of Apple’s biggest secret cash cows—essentially pure profit.

7. AppleCare & Repairs: Premium Protection Plans

Apple makes money not just from selling devices, but from protecting them too.

⚙️ AppleCare+ – A premium extended warranty with accident protection

🔧 Out-of-warranty repairs – Apple’s repair costs are notoriously high

💰 Revenue Source:

- AppleCare+ subscriptions

- Repair fees

Financial Impact: While AppleCare revenue isn’t explicitly broken out, Apple’s high-margin service business benefits hugely from warranty sales and repairs.

Why Apple’s Services Business Matters

✅ Higher Profit Margins – Services gross margin was 75% in Q1 FY25, compared to 39% for hardware

✅ Recurring Revenue – Subscriptions create predictable income

✅ Ecosystem Lock-In – The more Apple services you use, the harder it is to leave

With $26.3 billion in service revenue this quarter alone, Apple is transitioning into a services-first business.

While iPhone sales remain its biggest revenue driver ($69.1 billion in Q1 FY25), services ensure Apple stays profitable—even if people upgrade their devices less often.

If trends continue, Apple’s services business alone could soon be worth as much as a Fortune 50 company.